Our Prime Minister gave a clarion call for “Aatmanirbhar Bharat” to develop selfreliance in strategic sectors so as to reduce our import dependence and make India a hub for exports. This will be a long and arduous journey. However, no journey begins without taking out the first step forward and thus we should take the first small step without waiting for the entire road to be made. To become “Aatmanirbhar”, we require robust agriculture, services and manufacturing. Manufacturing holds the key as the share of manufacturing is abysmally low in our GDP and manufacturing alone can help the inclusive growth in India. We defied the conventional economic transition where the country moved from an agri-based economy to manufacturing based and then transformed into a sophisticated servicebased economy. Manufacturing is pivotal to our economy as over dependence of the population on agriculture needs to be brought down by absorbing, a large section of those dependent on agriculture, into manufacturing. How a sector which contributes to about 15% of GDP can support over 55% of the population?

Moreover, with industrial production being 15% of GDP, India can hardly be called an industrialised country. In Thailand, South Korea and China, industrial production is 27%, 28% and 29% of GDP respectively. Growth in exports is directly linked to the growth of industrial production. For any export to take place, we need a quality product and that too at a competitive price. At present, both are generally missing.

Exports can sustain only on robust and competitive manufacturing. Manufacturing, which can compete with the best globally while simultaneously effectively facing imports including duty free imports from our partners with whom we have signed Free Trade or Comprehensive Economic Partnership. Competitive manufacturing requires an eco-system built on proactive action both at the end of the Government and entrepreneurs. Government should address factors such as high cost and inadequate availability of credit, high cost of electricity, infrastructure inadequacies, high compliance cost, high logistics cost, labour law challenges etc. while industry should attempt raising productivity, reducing cost, bringing efficiency in operations, attaining scalability. Skilling should be a joint endeavour between the two so that skills relevant to employability is provided and further sharpening of skills may be left to industry.

The support given to the electronics sector by providing production linked incentive of 4-6% on incremental turnover for large companies, capital subsidies to electronic component manufacturers and establishment of Electronic cluster with 50% Government support would help in creating domestic capabilities and reducing import dependence. India would be investing in formulation manufacturing to reduce its dependence on imports particularly when it has acquired the tag of being “Pharmacy of the World.” We need to capitalise on the goodwill acquired with supply of Hydroxychloroquine to a large number of countries in the World.

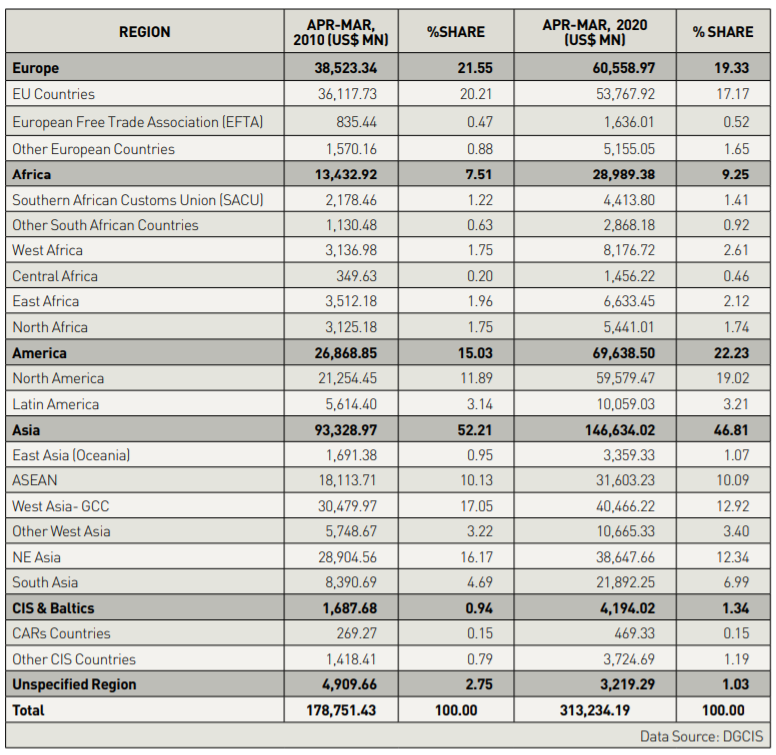

Indian exports have diversified in terms of products and markets. The share of developing and advanced economies, as destinations of Indian exports, has significantly changed over a period. The following table shows the diversification of India’s exports over last 10 years:

However, the evolution of our exports has not followed a traditional trend. The trends point to a contradiction in the Indian economy — a technologically advanced services sector, exporting high technology services, and a lagging manufacturing, exporting relatively low-value added products. The profile of our exports requires major change. We are largely in exports of apparels & textiles, footwear & leather goods, carpets & handicraft, gems & jewellery, marine and agro products etc. particularly looking into the number of exporters in these sectors. While these are extremely important for employment creation in the country, unfortunately, their share in global exports is on a decline. The top 5 products in global trade, together accounting for over 50%, are electrical and electronics products, petroleum goods, machinery, automobile and plastic goods. The share of these products in our exports is less than 33%. Our share in these 5 products, is little over 1% of Global trade though our overall share in Global exports stood at 1.7 % in 2019.

Industry needs to manufacture products which are much in international demand. The large share of global trade is accounted for by medium and high technology exports in which our share is negligible. We need to leverage professional manpower and the huge R&D base that exists in the country to take a quantum jump in technology exports. We should work on our strength and branding in software to push our hardware exports. The time has come to consolidate on generics and move to biosimilar and new drugs. In traditional exports also, focus should come on value addition, innovation, designs and product development.

Sustained growth of any activity cannot take place by riding on the back of grants and financial support. This should be a short-term measure. Indian manufacturing entails myriad taxes and duties at various stages in different forms so much so that at the end the finished product, in many cases, contains almost 15% of imposed tax and duties which are not refunded by any instruments. These include electricity duty, property tax, Mandi tax, Stamp duty, tax on petroleum and diesel consumed in manufacturing as well as transportation, compensation cess on coal, and various other taxes and duties. If all these taxes are refunded to the exporter, the competitiveness is imparted to our exports significantly.

Some of the regular fissures at the domestic turf, which are low hanging fruits, should be immediately and effectively addressed. Exporters spend a sizable fair share of their time in resolving local issues with Customs, GST, DGFT, Income-Tax and other Authorities. Very often export consignments are held up at Ports or nonsustainable demands are raised on exporters by field formations. Resolving these issues takes a lot of time and resources of exporters and they are left with little time for product development or marketing. There could be some black sheep but that should not mean class action against exporters in general. Exports can be increased by 25% by making the life of exporters a little more easy. Most of the exporters have impeccable track record and they should be given a green channel treatment in all Government Departments.

Land is the first requirement to start any industry. The easiest way to acquire industrial land is through the State Industrial Development Corporation (SIDC). Unfortunately, it takes anywhere from 6 months to 12 months to get the land allotted from any State Industrial Development Corporation. Why their procedures are so complicated and lengthy? If they have vacant land and the prices are pre-determined, there is no reason why land cannot be allotted within a month. There is a need to revamp SIDCs to make them industrial friendly and facilitator. The industrial estates developed by them are purely kept with minimum infrastructure. The cost of their services are also very high. The other alternative to purchase the land is by the private deal with the land owner. In this case, the major problem is that, in the most cases, a third party who is not shown in the land records claims partial ownership and files a case in the court. There is a need to make a law so that the seller is absolved of the liabilities and the claim if any, lies only with the seller. This will discourage frivolous litigation meant only for extortion. The Prime Minister mentioned the need to make each District as the country’s export hub. Once implemented, this would give a rich dividend not only for boosting exports but also providing employment and investment at the district level. It could be a game changer for the industry and will also improve infrastructure of the region. In Germany, every village, however small, has an industrial zone at the outskirt which is called Industriegebiet. This is the real reason for massive industrialisation of Germany. There should be an industrial estate, private or public, in every district. In a large district, there should be multiple industrial estates. The District Collector should be made responsible for industrialization of his district. At present the District Collectors’ offices are not proactively involved in promoting industries. In most districts, there is an issue of law and order, lack of amenities and the most difficult job is in getting land use changed. It should be possible for anyone to buy land and get it converted to industrial use within 60 days without running from pillar to post. The performance of the Collector should be judged by the industrial growth, he has achieved in his district. The Collector must personally visit important industries and attend to the burning issues the industry is facing. At present, the office of Collector is simply busy collecting land revenue and other taxes. There should be a nodal officer in each district fully empowered to address the issues of the industry. Industrial production can be increased substantially by going to the grass root.

Product wise exports diversification did happen during the last decade with a rising share of machinery, chemicals, plastics, marine and agriculture in our exports. However, decline in gems & jewellery and textiles have been a setback.

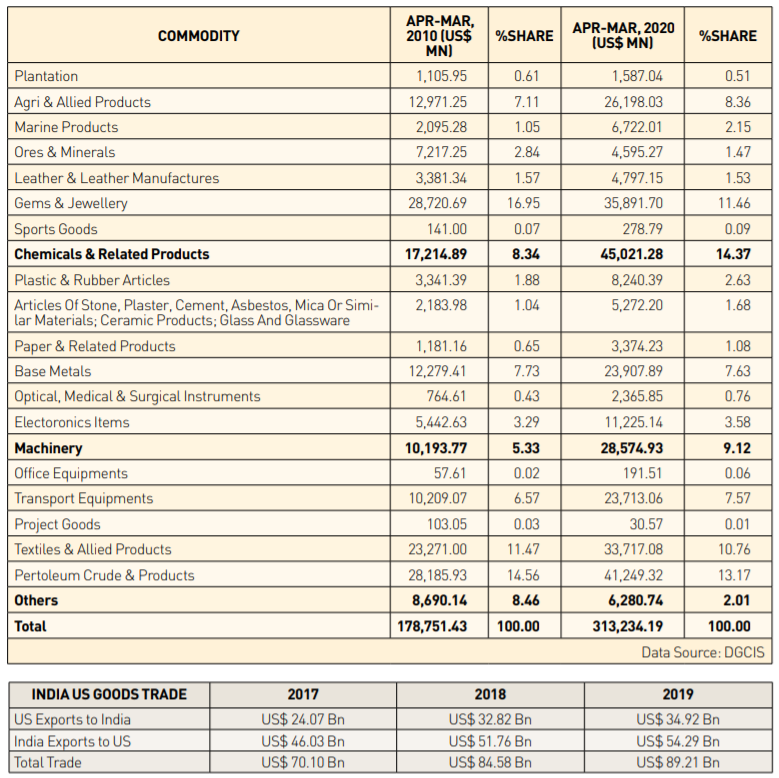

There is a need to engage and arrive at favorable free trade agreements with selected countries/regions like US, Canada, EU, UK, New Zealand and Australia. While our strategic interest lies with the US, our business interests are also furthered by entering into a comprehensive economic partnership with them to get better market access both of our goods and services including free movement of technical and professional persons. The rising trade between the two countries have created the required platform for such engagements addressing US concerns on trade deficit.

If we add, the services trade data as well, our bilateral trade relationship reaches close to $150 billion. Thus, the US accounts for 12.5% of India’s International trade of goods and services. A single country which accounts for 1/8th of our trade, automatically makes it eligible for such preferential trading arrangement. More so, when the trade pattern is on an upward trend both in imports and exports. Indian exports contracted in the post Covid period during March-June 2020 following lock down and dip in demand particularly in labour-intensive sectors such as handicrafts, carpets, apparel, footwear & leather and gems & Jewellery. However, pharma, surgical equipment, technical textiles, food & agri products, chemicals, plastics, petroleum products, electronics are all set to gain in the postCovid era. The remarkable flexibility shown by industry to manufacture N-95 masks, Personal Protection Equipments (PPEs) and Ventilators on large scale shows its resilience and potential. Amongst services, since the post-Covid period will see increasing focus on digitisation and automation, we expect IT & ITES, Tele medicines, R&D, Animation and Gaming to gain.

China’s image has taken a dent and countries will be extremely cautious and careful in importing from China particularly edible products. Thus India will have a huge opportunity in exports of fruits, vegetables, tea, cereals, meat and marine exports. Relaxation in Essential Commodities Act, Inter State movement, dispensing with APMC and selling agricultural commodities directly to exporters besides investment in agri infrastructure announced as part of stimulus will be of great support in the post Covid era.

As a matter of strategy, our exporters look into those countries which are providing demand stimulus like the US and Europe as demand will be back in such countries little early or which are witnessing anti -China sentiments including EU, Japan, South Korea, Australia and New Zealand. We should not focus too much on oil or commodity exporting countries of Middle East, LAC and CIS as crude and metal prices will continue to be subdued throughout during 2020 amidst low demand.

Trade in post-Covid will witness some paradigm shift, emergence of new exporting countries on the horizon and new non-tariff barriers regulating and restricting flows of the trade. We hope Covid-19, a pandemic causing global catastrophe, in the long term brings back focus on globalisation and international co-operation to help Indian exports to thrive.

Sharad Kumar Saraf is President, Federation of Indian Exports Organisations (FIEO) (Set up by Ministry of Commerce, Govt. of India) & Dr Ajay Sahai, Director General & CEO, FIEO.