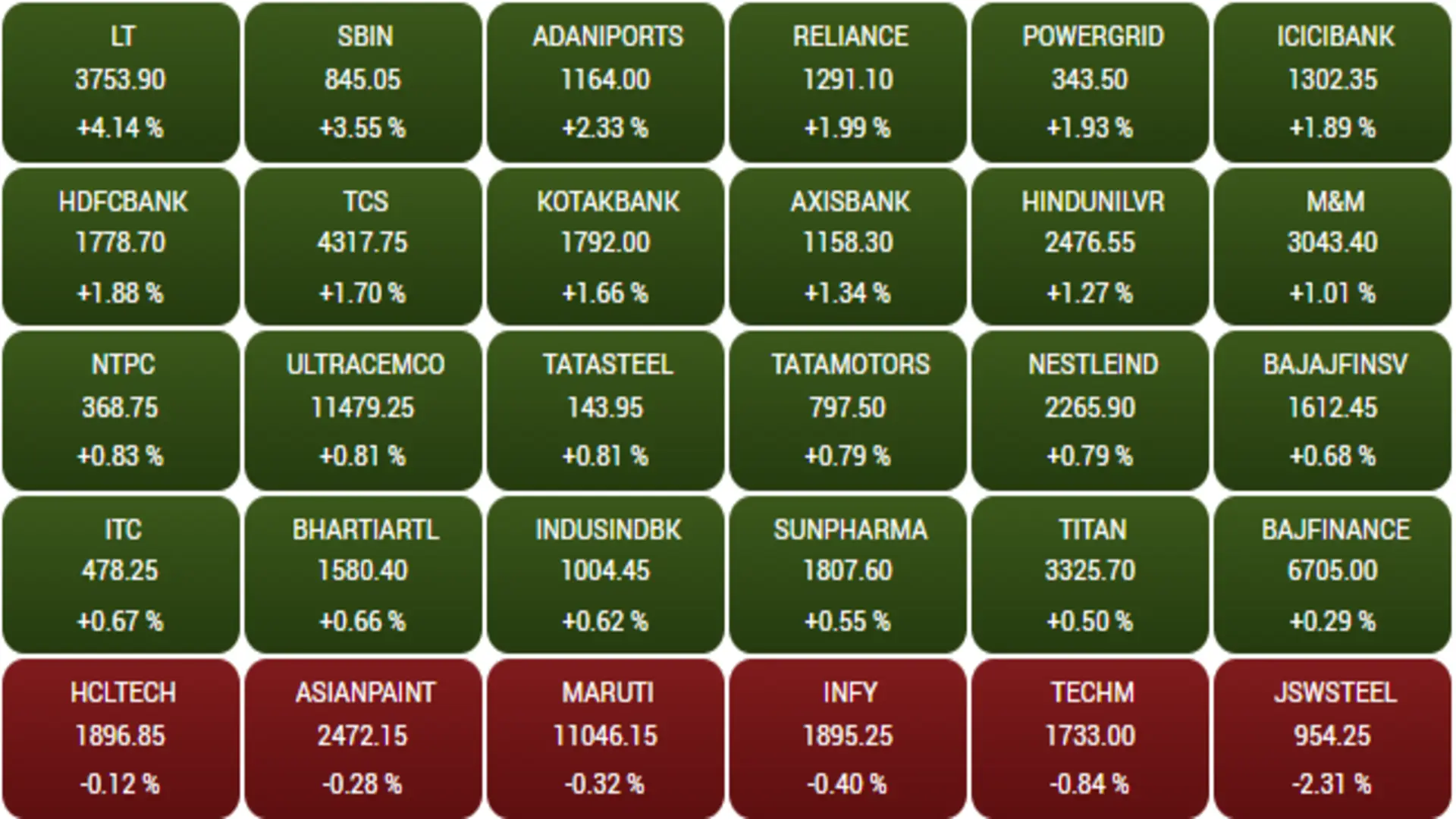

Indian stock markets posted notable gains on Monday, kicking off the week on a strong note and recovering some of their recent losses. The Sensex closed at 80,109.85 points, rising by 992.74 points (1.25%), while the Nifty ended at 24,221.90 points, up by 314.65 points (1.32%). All sectoral indices advanced, with Nifty Bank, PSU Bank, Realty, and Oil & Gas leading the rally.

Despite Monday’s gains, the Sensex remains around 6,000 points below its record high of 85,978 points. Recent declines have been linked to fund outflows, weaker-than-expected Q2 earnings from Indian companies, and elevated inflation levels.

Vinod Nair, Head of Research at Geojit Financial Services, noted that the results of major state elections had a positive impact on market sentiment, boosting confidence in government spending stability for the second half of FY2024-25.

“The rally was broad-based, with sectors like infrastructure, capital goods, and industrials outperforming due to expectations of increased order inflows. A positive outlook for H2 is supported by strong monsoon effects, festive demand, and the marriage season, which could help counterbalance the Q2 earnings downgrades,” Nair added.

Similarly, Vikram Kasat, Head of Advisory at Prabhudas Lilladher, highlighted the impact of political stability on market sentiment. “The BJP’s strong performance and its focus on growth-oriented policies have improved investor confidence, creating a conducive environment for potential market recovery,” Kasat said.

Foreign Portfolio Investors (FPIs), however, appear poised to close November as net sellers in Indian markets for the second consecutive month, following four months of net buying through September. Data from the National Securities Depository Limited (NSDL) indicates FPIs have offloaded stocks worth ₹26,533 crore in November.

Looking ahead, the Reserve Bank of India’s (RBI) upcoming bi-monthly Monetary Policy Committee (MPC) meeting will be closely monitored for indications on monetary policy direction. High food inflation has delayed anticipated rate cuts by the central bank.

Additionally, GDP data for the July-September quarter, to be released at 4 pm on November 29, is expected to provide further economic insights. The Indian economy grew 6.7% in the April-June quarter, falling short of the RBI’s forecast of 7.1%.