An Indian-origin businessman, Bankim Brahmbhatt, has been accused of orchestrating a massive financial fraud that has left global lenders scrambling to recover more than $500 million. The alleged scam involves fake loan collateral, fabricated financial documents, and false customer accounts tied to Brahmbhatt’s telecom businesses.

The Massive Fraud Unfolds

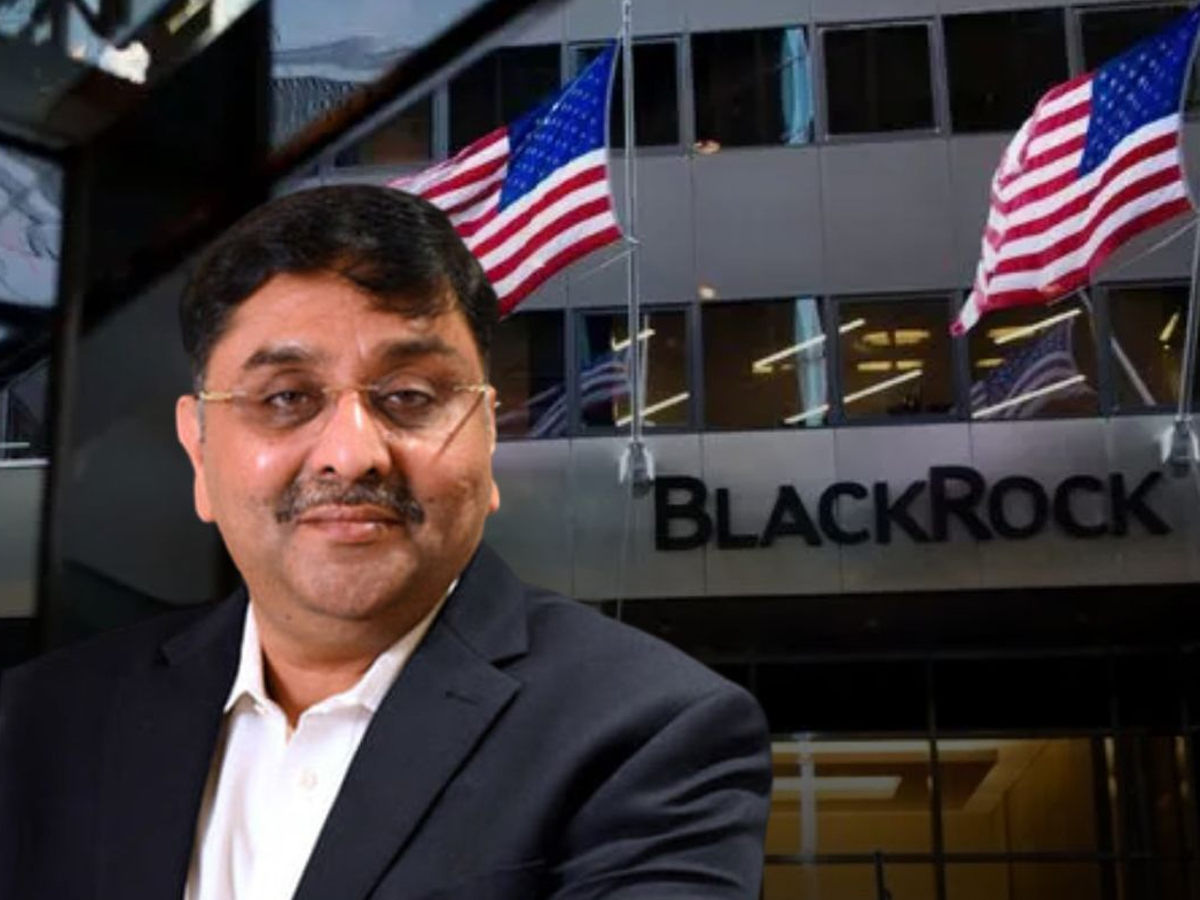

According to a report by The Wall Street Journal, Brahmbhatt’s companies—Broadband Telecom and Bridgevoice—are accused of fabricating accounts receivable used as collateral for loans. The alleged fraud has affected several major lenders, including BlackRock’s private-credit investing arm, which recently acquired HPS Investment Partners.

The lenders claim that every customer email and contract submitted over the past two years was fabricated, and that fake documents date back as far as 2018. Lawyers for the lenders said, “Brahmbhatt created an elaborate balance sheet of assets that existed only on paper.”

Investigators also allege that he shifted collateral assets to offshore accounts in India and Mauritius, further complicating recovery efforts.

Who Is Bankim Brahmbhatt?

Bankim Brahmbhatt is the owner of Broadband Telecom and Bridgevoice, both part of the Bankai Group, a company that describes itself as a “globally recognized leader in the telecommunications industry.” He was listed as the President and CEO of the group, which provides telecom infrastructure and connectivity solutions to operators worldwide.

🎉 Wishing a Very Happy Birthday to Our President & CEO, Mr. Bankim Brahmbhatt!#Bankaigroup #BankimBrahmbhatt #HappyBirthday #CEO #Leadership #Inspiration #Gratitude #BusinessLeader #CelebrateLeadership pic.twitter.com/u42KwejEU8

— Bankai Group (@Bankai_Group) July 19, 2025

Until recently, Brahmbhatt operated from Garden City, New York, where his offices were based. A visit to his home reportedly revealed several luxury cars, including a Porsche, Tesla, BMWs, and an Audi.

His LinkedIn profile appears to have been deleted, and public information about his background remains limited.

The Financial Web

Lenders allege that Brahmbhatt built a complex network of financing vehicles, including Carriox Capital and BB Capital SPV, which collectively borrowed hundreds of millions of dollars from private-credit investors. According to reports, BNP Paribas helped finance the loans, though the bank has not commented publicly on the matter.

As the investigation deepens, the Paris-based bank and other investors are now working to track where the money went.

Bankruptcy and Legal Fallout

In August, Brahmbhatt’s telecom firms filed for bankruptcy protection, followed by Carriox Capital II and BB Capital SPV. On August 12, Brahmbhatt himself filed for personal bankruptcy, the same day his companies entered Chapter 11 proceedings.

While he disputes the fraud allegations, lenders are now trying to recover their investments and trace the funds allegedly moved offshore.