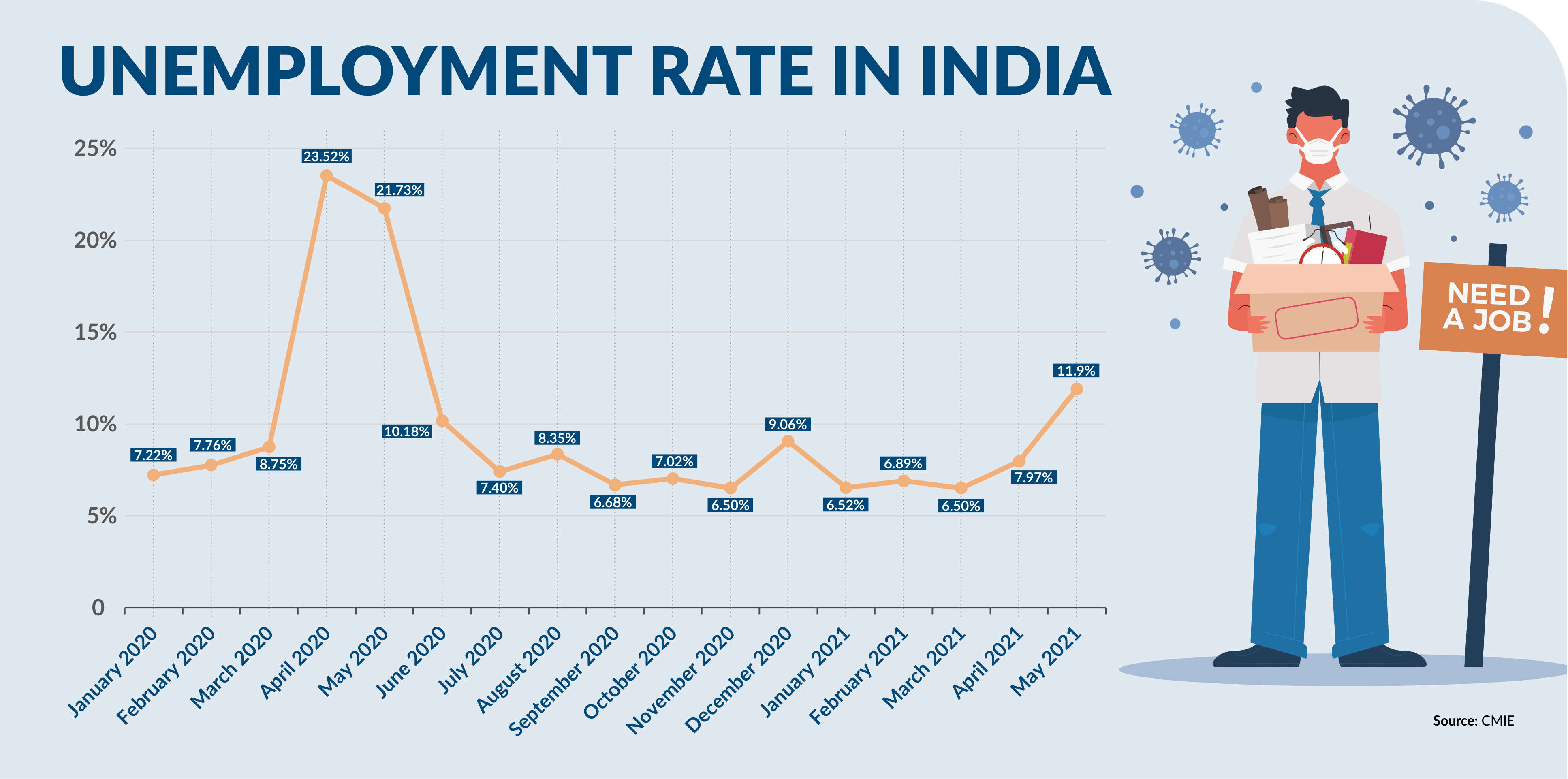

While the Indian economy continues to struggle with a sluggish growth rate and high unemployment, the IT sector has actually been one of the biggest winners. IT firms in India, which constitute a significant portion of the services sector in the country, saw record deals during the COVID-19 pandemic. Tata Consultancy Services (TCS) clocked in deals totaling USD 9.2 billion in Q4 FY21, its highest ever in a quarter, the total being over USD31.5 billion in the last fiscal year. Similarly, Infosys recorded USD 14 billion in deals in total, while WIPRO signed 12 large deals with a total contract value of USD 1.4 billion in Q4 FY21. This should be good news for the domestic IT sector. However, a recent report published by the Bank of America detailing the future of work, automation, and the IT sector points to a worrying trend of robot process automation, or RPA, taking away 30 per cent of jobs in this field. If this is true, it would threaten the livelihoods of around three million Indians, and for a country that is already struggling with a high unemployment rate of 11.8 per cent (CMIE, May 2021), this would add to the stress the economy is already under.

Photograph by Creative Commons

Photograph by Creative Commons

UNDERSTANDING INDIA’S SERVICE SECTOR Photograph by Aranami | Creative Commons

Photograph by Aranami | Creative Commons Photograph by Ford Asia Pacific | Creative Commons

Photograph by Ford Asia Pacific | Creative Commons

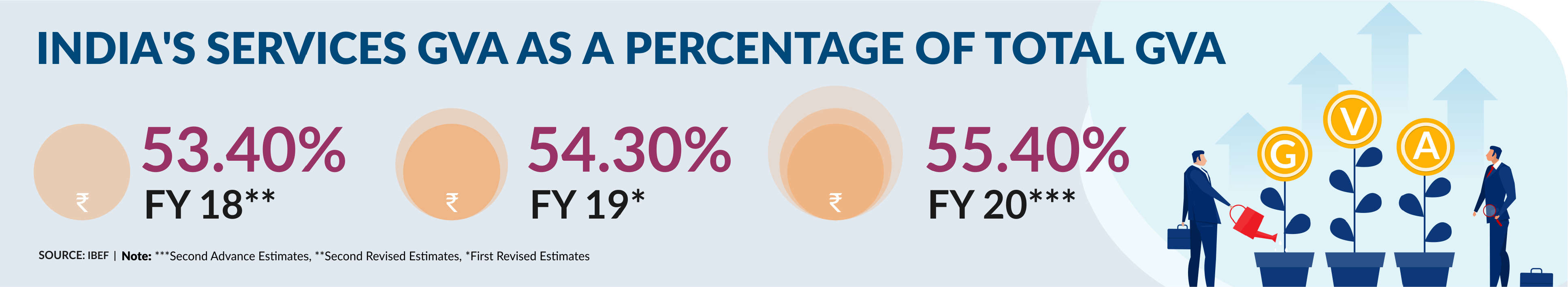

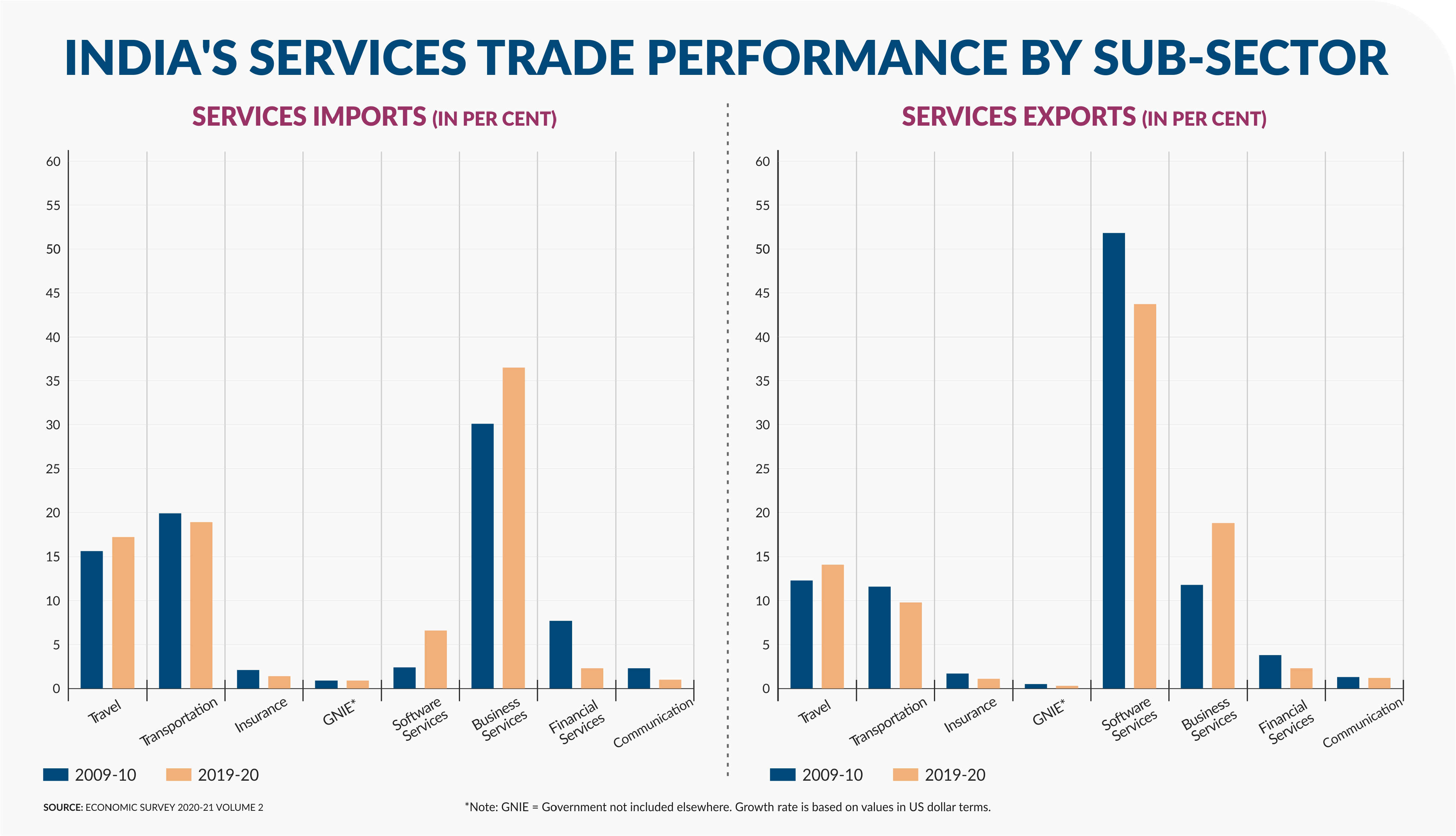

The service sector is one of the most significant building blocks of the Indian economy, contributing more than half of the Gross Value Added (GVA) of the country. The GVA from the services sector grew at a Compound Annual Growth Rate (CAGR) of 1.45 per cent to USD 1,064.8 billion in FY20 and comprised over 55 per cent of the GVA of the country. Service exports also comprise a major part of the total exports from India. According to the Reserve Bank of India (RBI), in January 2021, service exports stood at USD 17.07 billion, while imports stood at USD 10.09 billion. The service sector accounts for two-thirds of total Foreign Direct Investment (FDI) inflows and 38 per cent of total exports. The services category ranks first in FDI inflow as per data released by the Department for Promotion of Industry and Internal Trade (DPIIT). According to data released by the RBI, the sector is also the biggest employer in the country, with a share of around 44.4 per cent.

The growth trajectory of the Indian economy has been unusual as compared to developed countries, which have traditionally relied on manufacturing-led economic growth. India, on the other hand, relies on the growth of the services sector to fuel its economic growth. When we look at historical data, we find that between the financial years 1950 and 2012, the annual average contribution of the services sector to Gross Domestic Product (GDP) growth was 54.4 per cent. However, between 2011-12 and 2019-20, its contribution to the growth increased to a whopping 67.7 per cent. The service sector also provides employment to around 44.2 per cent of the Indian population, while 43.2 per cent is employed in agriculture. The manufacturing sector accounts for 11.4 per cent of the same. The main industries that constitute a significant proportion of the services sector in India include Information Technology (IT), Business Process Management (BPM), transportation, healthcare, insurance. and financial services.

The importance of the service sector in the economy had been understated in the past.The lack of a blueprint for the development of the sector adversely affected its growth. The services sector is not only important for the growth of the Indian economy, but also plays a role in ensuring the population has access to basic services such as health and education.

WHAT IS HAPPENING TO THE IT SECTOR? Photograph by Niti Aayog

Photograph by Niti Aayog

In the last few years, the Indian IT-BPM industry has been the flagship services export from India. Over the last decade, the industry has recorded a growth rate of around 102 per cent while earning revenue of around USD 190.5 billion (2019-20). IT services constitute a majority of the services in the sector, constituting around USD 97 billion in revenue in 2019-20. Other significant sectors include software and engineering services (21 per cent with USD40.2 billion revenue) and CPM services (19.8 per cent). A significant part of the industry is export-oriented with export revenues recorded in an excess of USD 146 billion in 2019-20. Out of the total export revenue, IT services contribute around USD 79.1 billion, accounting for 54 per cent of the exports. BPM and software products and engineering services account for the remaining 46 per cent.

The domestic revenue of the IT industry is estimated at USD 44 billion and export revenue is estimated at USD 147 billion in FY20. The IT sector in India employs around 16 million people, out of which 9 million are employed in low-skilled services and Business Process Outsourcing (BPO). The report published by the Bank of America earlier this month which revealed that 30 per cent of around three million jobs in the sector will be lost by 2022, also detailed that proposed layoffs will help the software companies save USD 100 billion, mostly in salaries,annually.

According to the report, around 0.7 million roles will be replaced by RPA alone and the rest will be due to other technological upgrades and upskilling by domestic IT players. RPA is likely to have the largest impact in the United States with a loss of almost 1 million jobs. Another key reason for RPA-driven job losses is that many countries that had offshored and outsourced their work in the past are likely to bring the jobs back to their home markets. Developed countries, which offshored IT jobs previously, will look at native IT workers or RPA to secure their digital supply chains to establish reliance on their own technological infrastructure, rather than banking on another country. It also goes on to warn that emerging economies such as India and China are at the highest risk of technologically driven disruptions.

However, the National Association of Software and Service Companies (NASSCOM) issued a statement after this report was released, claiming that the BPO sector actually continues to be a net hirer of skilled talent, and has in fact added 138,000 jobs in FY2021. NASSCOM also stated that the nature of the BPO sector in India has been evolving constantly, and that the impact of RPA and any other automation has led to a net creation of jobs for the BPM sector over the last two years.

AUTOMATION = JOB CUTS?

While the scale of automation in the IT sector is likely to have an impact on jobs in India, there are steps, including upskilling of workers and adoption of better policies, which can help foster growth of jobs in the sector. With the ongoing COVID-19 pandemic, an increasing number of companies have been shifting their base of operations from China, and India could be poised to fill a sizable portion of these jobs. Recently, Japan offered incentives to Japanese companies to shift their manufacturing base from China to India. Additionally, India has overhauled its legal, regulatory, and policy framework (such as indirect tax, insolvency, land, and labour laws) to rapidly jump the ease of doing business global index, which is likely to attract more industries into the country.

Subsequent industrial revolutions have changed the way production and supply of goods and services has been organised. With that, the nature of employment has shifted from low-skilled to high-skilled labour and revolution in the services sector through IT has further marked this transition. However, the fear that this transition will always mean a loss of jobs is not entirely true. According to several studies and reports, artificial intelligence (AI), robotisation, and automation would open avenues for new jobs rather than generating job losses. For instance, a significant share of the developed countries’ applications of AI are in the finance, transportation, healthcare, and defence sectors. In India, too, we have approximately seven per cent of workers in these sectors. The use of robots and AI is chiefly in the fields of manufacturing, construction, rescue operations, and personal security. As the dominance of these sectors in the economy increases, the level of employment will also increase, along with support services for these sectors.

Moreover, not all industries would be able to afford automation, primarily for cost reasons, and with an increase in automation and AI in other sectors, these technologies will open avenues for new jobs in information and communication technologies and data sciences. According to a World Economic Forum (WEF) research, by 2025 more than half of all current workplace tasks will be performed by machines as opposed to 29 per cent today. However, in terms of overall numbers of new jobs, the outlook is positive, with 133 million new jobs expected to be created by 2022, in comparison with the 75 million that will be displaced.