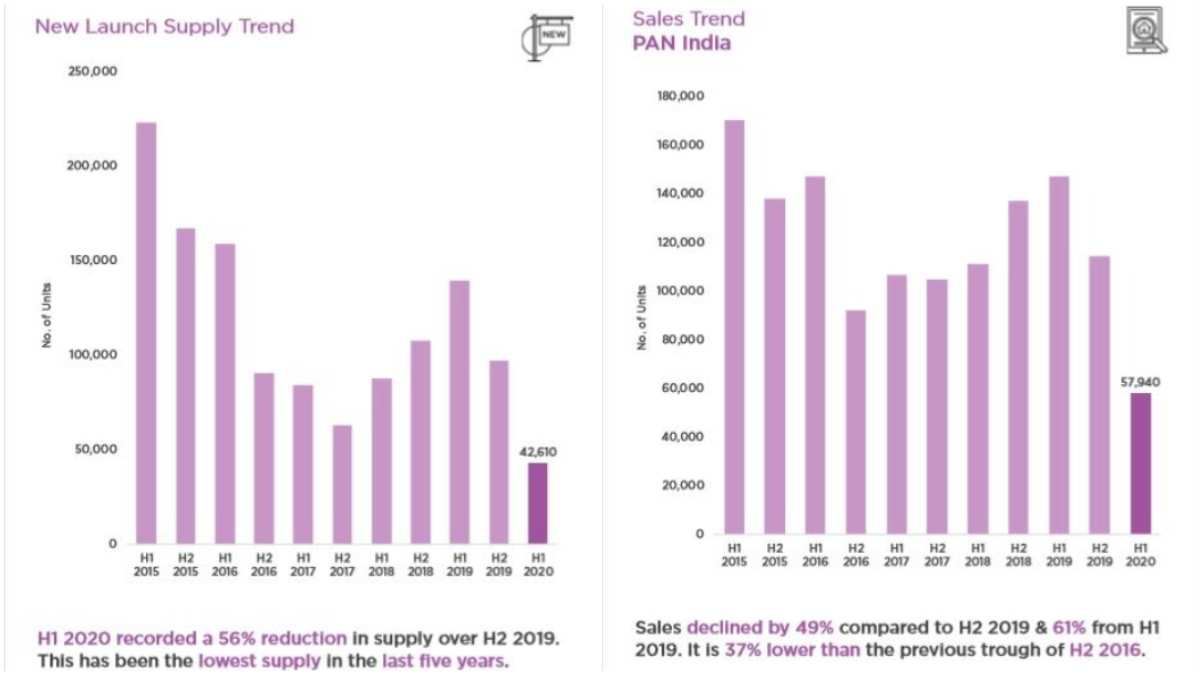

The overall slowdown in the economy and the impact of Corona has heavily impacted the sales of the real estate market. As many as 40 sectors that are dependent on the real estate industry also have been affected by the same. The news for the real estate industry doesn’t seem to be rosy for the next few quarters until the growth rates move north and people find their jobs secure enough to take a loan to buy an apartment.

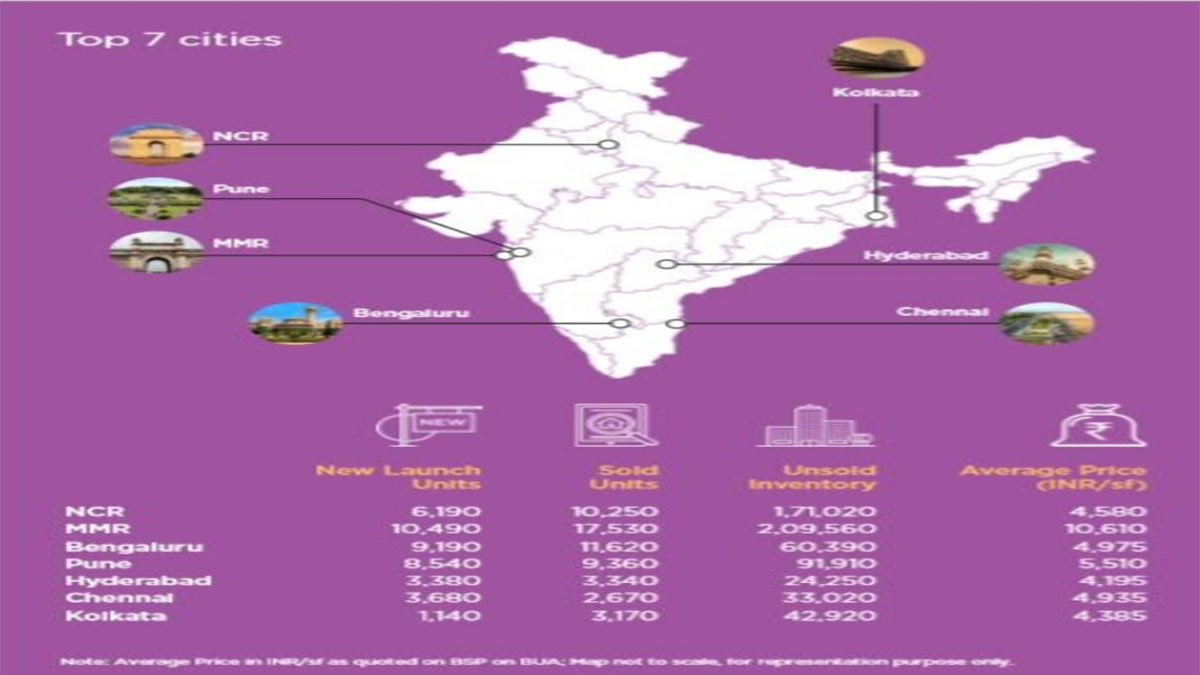

In the first half of the 2020, sales of housing units witnessed a steep decline in major cities, sales in National Capital Region and Mumbai declined by 61 per cent each, in Bengaluru by 60 per cent, Pune by 59 per cent and Hyderabad by 66 per cent, while Chennai and Kolkata witnessed decline of 58 per cent. Unsold inventory in Mumbai Metropolitan Region touched a high of 2.09 lakh units, while NCR came a close second with 1.71 lakh units.

One of the significant trends likely to emerge in Indian real estate in post-COVID-19 world would be that reverse migration could spur housing demand in Tier 2 & 3 cities. Currently, the top 7 cities account for almost 70% of India’s residential market, with the remaining 30% accounted for in Tier 2 & 3 cities. This ratio may well change in the times to come, said Anuj Puri, Chairman of Anarock property consultants in response to a emailed question sent by this writer.

Top tier 2 & 3 cities in demand, particularly in North and West regions, include Lucknow, Indore, Chandigarh, Jaipur, Ahmedabad, Surat and Nashik among others. They would be the main beneficiaries of the reverse migration of professionals who have either lost their jobs in the metros or are likely to. These returnees will benefit from the cost of living and superior infrastructure that many of these Tier 2 and Tier 3 cities provide. Also, cities like Ahmedabad or Kochi in south – that previously also attracted NRIs – will further see rise in demand by them. Many NRIs may want to return to India amidst dwindling job prospects, particularly in the US and European nations which account for more than 65% global cases, Puri said in an emailed answer.

Further, Anarock’s most recently conducted consumer sentiment survey revealed that out of all participants who would prefer to buy in any of these Tier 2 & 3 cities, 61% are end-users while remaining are buying for investment purpose. At least 47% of these end-users have a budget of less than Rs. 45 lakhs, followed by 34% whose budget is anywhere between Rs. 45 lakh to Rs. 90 lakh budget.

The market dynamics of the real estate are changing and consolidation is causing branded players to gain market share to the tune of 75% – 80%. Whereas, township projects that account for only 5% across the major cities are likely to rise in the future as residents would prefer to work-liveplay in controlled environment The design specifications are likely to be altered going forward as there will be a higher demand for flexible homes that are capable of functioning as office and classrooms if required.

Prices are likely to remain rangebound as developers will be keen to liquidate existing inventory. Work from home is likely to find acceptance in the Indian corporates, causing a spike in reverse migration of professionals. As a result, housing demand may gain momentum in tier II and tier III cities.

For the benefit for our readers, we are attaching statistics which shows the state of the real estate industry.