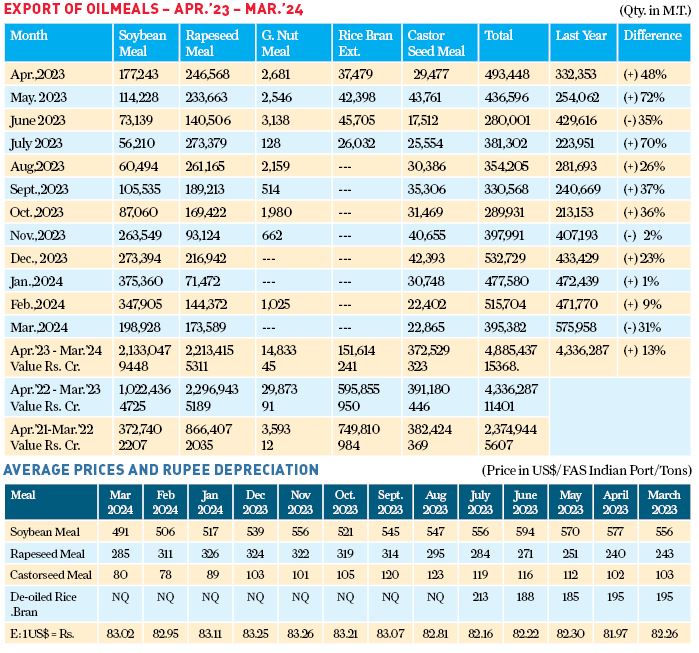

The overall exports of oilmeals during Apr 2023 – Mar 2024 increased at 4,885,437 tons (provisional) valued at Rs. 15,370 crores compared to 4,336,287 tons valued at Rs. 11,400 crores during the same period of previous year, up by 13% in term of quantity and 35% in term of value, according to the Solvent Extractors’ Association of India (SEA).

SEA’s the data for export of oilmeals for the month of March, 2024 (provisional) reported at 395,382 tons compared to 575,958 tons in March 2023, down by 31%.

However,

This is highest export of oilmeals since 2013-14 in term of quantity and value. Previously during 2013-14, India had exported 43.81 lakh tons of oilmeals valued at INR 11,500 crores.

Export of Soybean Meal – More than doubled in 2023-24

The export of soybean meal revived during the year and reported at 21.33 lakh tons compared to 10.22 lakh tons during the same period of last year as Indian soybean meal was most competitive in the international market. However, currently as on 15th Apr.,2024, Indian soybean meal Ex-Kandla has quoted at US$ 490 per ton while soya meal Argentine cif Rotterdam at US$ 417 per ton facing strong competition from Argentine origin and likely to slow down in coming months.

Export of Rapeseed Meal – Stagnant in 2023-24

The export of rapeseed meal during the year reported at 22.13 lakh tons compared to 22.97 lakh tons during the same period of last year i.e. more or less same, thanks to increased production of rapeseed in India in last three years. In case of rapeseed processing in India likely below potential in coming months due to disparity in crushing. The export sale of rapeseed meal have slowed down pronouncedly of late owing to growing competition from soya meal on the world market.

Ban on Export of De-oiled Ricebran Extended till 31st July, 2024

The export of De-oiled Ricebran allowed till end July’23 and then banned w.e.f. 28th July, 2023 to 31st July, 2024. The export of De-oiled Ricebran during April to July 2023 reported only 1.52 lakh tons. The ban on export persisting Rice Bran Processors in Eastern India are now confronted with the looming threat of shutting down their operations. This not only adversely impacts the rice milling industry but also poses a risk to the overall production of Rice Bran Oil.

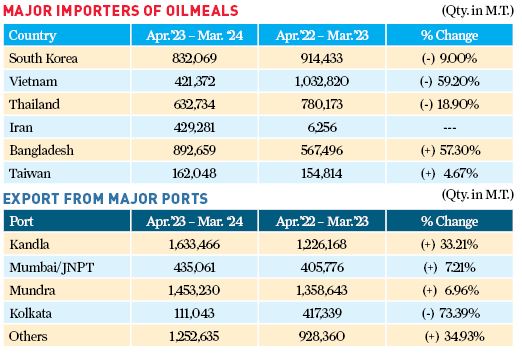

Major Importers of Oilmeals

Bangladesh become a largest importer of Indian oilmeals and reported 8.92 lakh tons consisting of 4.34 lakh tons of rapeseed meal, 4.31 lakh tons of soybean meal and 0.28 lakh tons of De-oiled ricebran.

South Korea become the second largest importer of Indian oilmeals and reported at 8.32 lakh tons of oilmeals consisting of consisting of 547,763 tons of rapeseed meal, 226,407 tons of castorseed meal and 57,899 tons of soybean meal.

Thailand also become the third largest importer of Indian oilmeals and reported at 6.33 lakh tons of oilmeals out of which 6.16 lakh tons rapeseed meal.

Iran has turned out to be largest importer of Soybean meal from India (including shipment via Dubai) and imported a record quantity of soybean meal of 8.64 lakh tons during the financial year 2023-24.

Major Ports – Export of Oilmeals

Kandla become a largest port for export of oilmeals and reported 16.33 lakh tons of oilmeals consisting of 9.50 lakh tons of soybean meal and 6.82 lakh tons of rapeseed meal.

Mundra become the second largest port for export of oilmeals and reported 14.53 lakh tons of oilmeals consisting of 9.61 lakh tons of rapeseed meal, 3.48 lakh tons of castorseed meal and 1.39 lakh tons of soybean meal.

Mumbai/JNPT become a major ports for export of soybean meal mainly in containers from Maharashtra State.

Most of the oilmeals prices in one year reduced in term of US$ per tons except Rapeseed meal which is slightly improved. The rupee remained more or less stagnant and moved slightly up from INR 82.26 to INR 83.02 against US$.