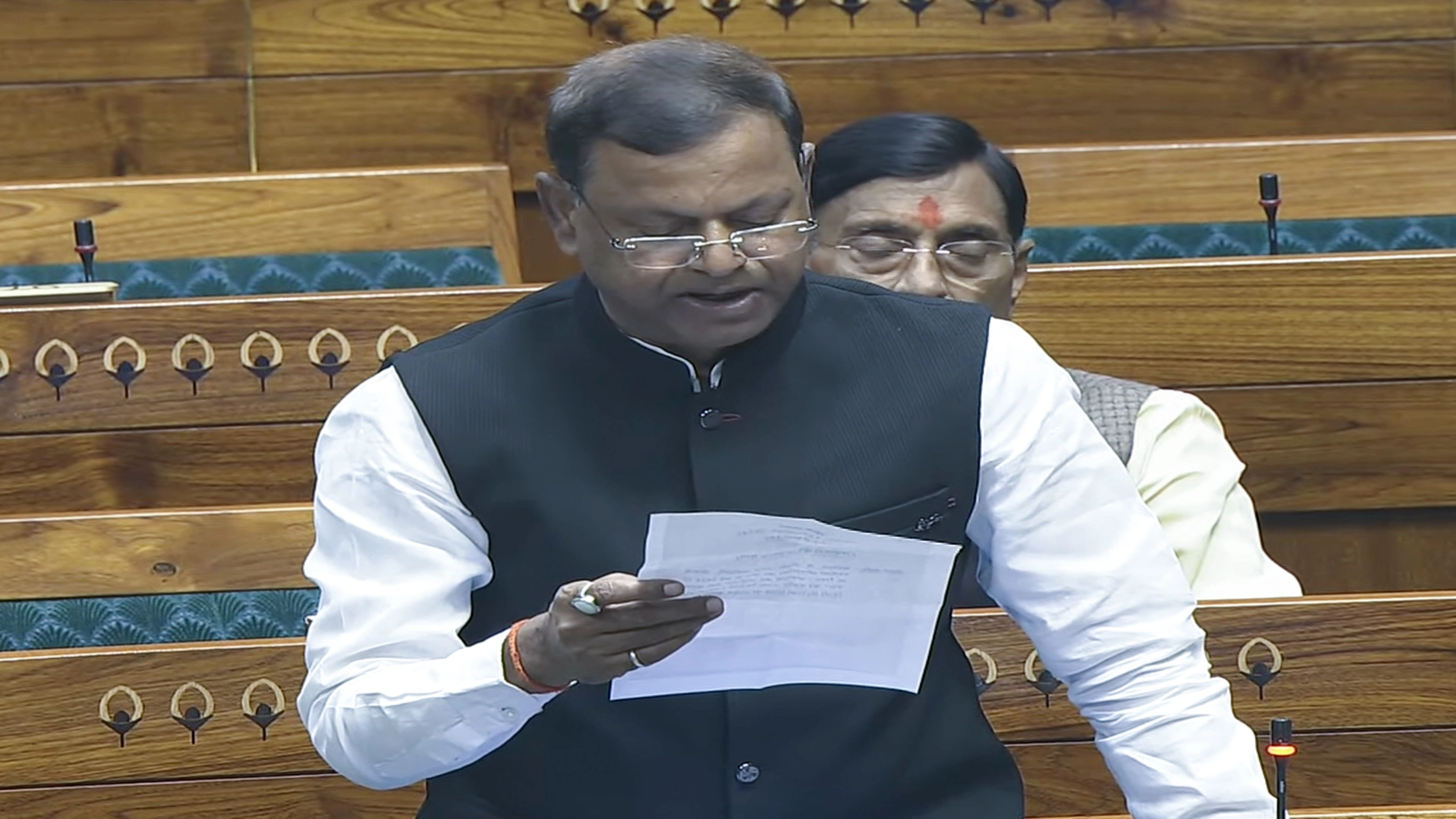

In the financial year 2023-24 the nda government has so far generated Rs 8,625 crore through minority stake sales as part of its disinvestment process said Minister of State for Finance, Pankaj Chaudhary, shared this information in a written response to the Lok Sabha on Monday.

The minister also clarified that the government has ceased setting separate disinvestment targets or estimates since the revised estimates (RE) stage of 2023-24. Consequently, no specific disinvestment target or estimate has been announced for the financial year 2024-25. Despite this, the ₹8,625 crore realized through disinvestment reflects the ongoing activity in this domain.

Modes of Disinvestment

The government typically pursues disinvestment through two primary methods:

Minority Stake Sale: Selling smaller portions of its holdings in public sector enterprises (PSEs).

Strategic Disinvestment: Selling a substantial or entire shareholding of a central public sector enterprise (CPSE), often coupled with transferring management control.

Strategic disinvestment can involve either transferring government equity and management control to a private strategic buyer (privatization) or transferring these to another CPSE.

Policy Rationale

The government’s strategic disinvestment and privatization policies are grounded in the principle that the state should withdraw from sectors where competitive markets have matured. Such entities are believed to perform better under strategic investors, benefiting from factors like capital infusion, technological advancements, and more efficient management practices.

It was emphasised that the financial profitability or loss of a CPSE is not a criterion for deciding whether to pursue privatization or strategic disinvestment.

Challenges and Progress

The disinvestment process is ongoing and dependent on several factors, including:

Market conditions

Domestic and global economic outlook

Geopolitical considerations

Investor interest

Administrative feasibility

Since 2016, the government has given ‘in-principle’ approval for strategic disinvestment in 36 cases involving PSEs, subsidiaries, units, joint ventures, or banks.

The minister’s statement highlights the complexity and dynamic nature of the disinvestment process, driven by broader economic and strategic goals rather than fixed targets or profitability metrics.