Fiscal Deficit (FD) is the adverse fiscal balance which is a difference between the Revenue Receipts Plus Non-Debt Capital Receipts (NDCR) i.e. total of the non-debt receipts and the total expenditure. FD is reflective of the total borrowing requirement of the Government. Revenue Deficit (RD) refers to the excess of revenue expenditure over revenue receipts.

Effective Revenue Deficit (ERD) is the difference between a Revenue Deficit and a Grant-in-Aid for Creation of Capital Assets. Primary Deficit is measured as Fiscal Deficit less interest payments. Effective Capital Expenditure (Eff-Capex) refers to the sum of Capital Expenditure and Grants-in-Aid for Creation of Capital Assets.

In 2014, the economy was beset with high fiscal and current account deficits and double-digit inflation. Now, inflation is under control, the fiscal deficit is trending lower, the current account deficit is just above one per cent of GDP, and foreign exchange reserves cover nearly eleven months of imports. It has been a journey from fragility to stability and strength.

During the period 2009-2014, the government tried to sustain high growth by running high fiscal deficits and keeping monetary policy too loose for long. Nominal GDP growth was high because of high inflation. India experienced annual double-digit inflation rates for five years from 2009 to 2014.

The country had to contend with high twin deficits -both fiscal deficit (4.9 per cent in FY13) and current account deficit (4.8 per cent in FY13)-and the rupee was overvalued. It all came to a head in 2013 and the Indian rupee crashed against the US dollar. Between 2009 and 2014, the Indian rupee depreciated annually by 5.9 per cent. Economic growth stalled.

Union Finance Minister Nirmala Sitharaman on Thursday announced in her interim Budget that the fiscal deficit is estimated to be 5.1% of the gross domestic product in the financial year 2024-’25.

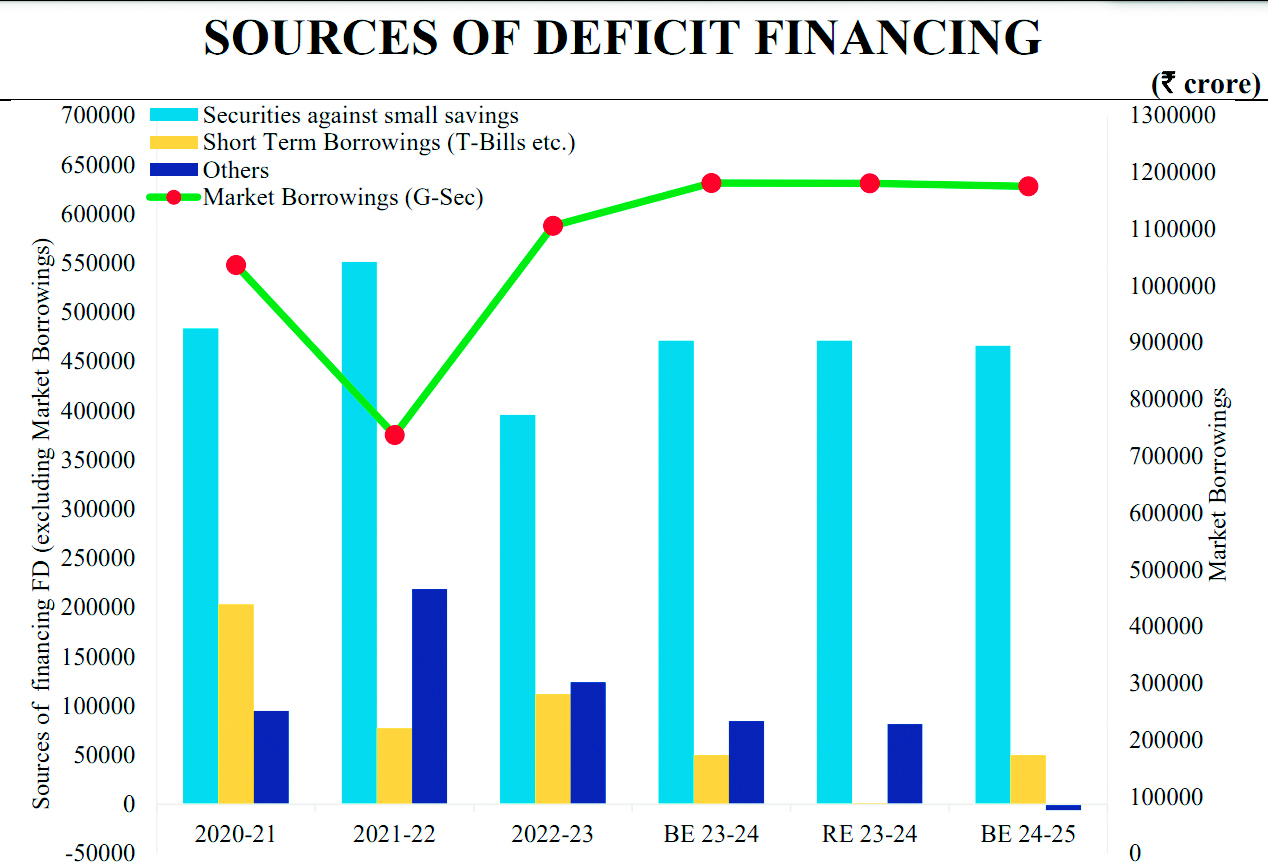

The country’s total borrowing during the next fiscal has been estimated at Rs 14.13 lakh crore, Sitharaman said.

The Finance Minister identified the fiscal deficit for FY 2019-20 at 3.8%(RE) and pegged it at 3.5% (BE) for FY 2020-21 which is consistent with the government’s abiding commitment to macroeconomic stability as part of Medium Term Fiscal Policy cum Strategy Statement 2020-21.

She said, “Section 4(2) of the FRBM Act provides for a trigger mechanism for a deviation from the estimated fiscal deficit on account of structural reforms in the economy with unanticipated fiscal implications. Therefore, I have taken a deviation of 0.5%, consistent with Section 4(3) of the FRBM Act, both for RE 2019-20 and BE 2020-21.”

The Finance Minister in order to settle the debate over the credibility and transparency of the projected fiscal numbers said “Let me assure the House that the procedure adopted is compliant with the FRBM Act. This is also consistent with the practices hitherto followed.”

There is a fiscal deficit when the government’s expenditure is more than the revenue it generates in a given financial year.

India’s fiscal deficit in the current financial year 2023-’24 is expected to be 5.8%, Sitharaman said. This figure is marginally below the previous Budget estimate of 5.9%.

The Union government will continue on the path of fiscal consolidation to reach a fiscal deficit target below 4.5% by the financial year 2025-’26, Sitharaman said.

In recent years, the fiscal deficit has risen sharply. It swelled from 3.8% of the gross domestic product in the financial year 2019-’20 (revised estimate) to 9.5% in the following fiscal (revised estimate). This rise was mainly driven by the government’s expenditures on welfare during the Covid-19 pandemic.

In the current financial year, the government had estimated total borrowings of Rs 15.4 lakh crore.

On January 29, days ahead of the Budget, the finance ministry in a report had said that the country’s real gross domestic product growth will be close to 7% in the financial year 2024-’25.

The Budget on Thursday was Sitharaman’s sixth consecutive one as the finance minister.

With the term of the current Bharatiya Janata Party-led Union government ending in the coming months, a full Budget for the financial year 2024-’25 will likely be presented in July, after a new government is sworn in.

An interim Budget only outlines the expected income and expenditure of the Centre for the upcoming financial year. Interim Budgets typically do not include any significant policy changes or announcements of new schemes.