INTRODUCTION

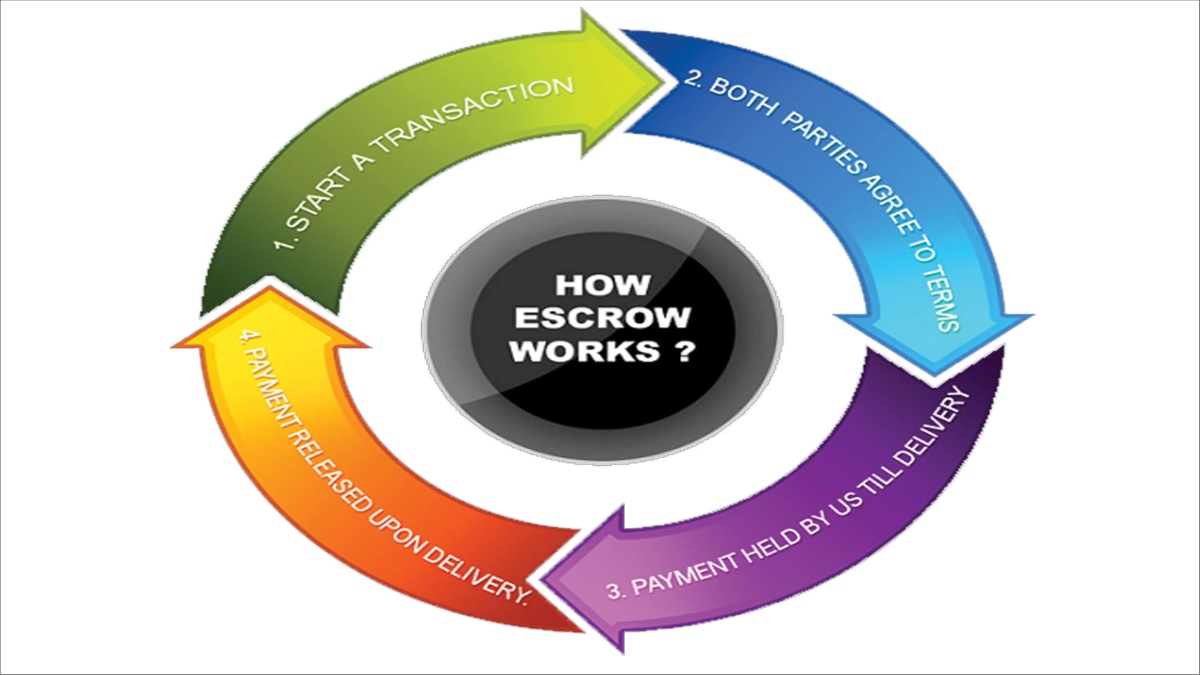

An Escrow Arrangement is a monetary instrument whereby a third-party, i.e. an Escrow Agent, holds liquid assets for the benefit of two parties who have entered into an exchange/transaction, and dispenses it upon the fulfilment of a specific set of obligations on the part of both the parties under a contract.

An Escrow Agreement generally inculcates the following information:

- Credentials of the appointed Escrow Agent;

- Escrow Funds and the contingencies for its disbursement;

- Specific utility of the funds by the Escrow Agent;

- Duties, Liabilities, Fees, and Expenses of the Escrow Agent;

- Jurisdiction and Venue in the event of legal action; etc.

Popular Purposes of an Escrow Agreement: The primary purpose of an escrow agreement is to ensure that each party adheres to their end of the bargain, and can be seen as a mediator of the transaction since the transfer of assets is contingent upon the fulfilment of the terms set under the agreement.

This kind of setup may be used for agreements that have the following characteristics: i. Large Transaction Value;

- Standard quality of work to be ensured by the Buyer, prior to its payment;

- Seller’s uncertainty of undertaking large-scale work without any assurance of payment;

- Where the transaction needs to be completed in steps, i.e. partial release of funds upon the completion of predetermined milestones; etc

Escrow Arrangements are largely incorporated in the areas of real estate, leases, mortgages, online transactions, mergers and acquisitions, project finance transactions, and transactions involving overseas market. India’s Position on Escrow Mechanism:

India’s 163rd position in the world for enforceability of contracts calls for the emergence of escrow arrangements as a unique and novel mechanism in its commercial sectors that adds an extra layer of transparency in the payments’ ecosystem, aiding in the development of trust.

Escrow, despite being an age-old concept globally, has so far been restricted to the sectors of M&A, real es tate, etc., but has been on the rise owing to the dynamic technological and internetbased economy. Qualifications for an Escrow Agent:

An Escrow Agent, as stated above, is an individual/entity that holds valuable assets, as a fiduciary responsibility, for third parties while a transaction is being finalized or a disagreement is resolved. Assuming the role of an escrow agent by attorneys is a common practice worldwide, however, to understand the stance in India, the principles laid down in two judgments have to be taken into account.

In Jeweltouch (India) Pvt. Ltd. v. Naheed Hafeez Quraishi & Ors., it was observed that an escrow agent could be appointed by the concerned parties as such person who shall determine whether a promise or precondition has been satisfied or not so as to warrant the release of documents from escrow. “Parties to a deed, by the lodgment of the document in escrow evince an intent that the document shall be released subject to the fulfilment of the condition under which it is held in escrow. Documents which are held in escrow are sometimes delivered into the custody of a stranger while on other occasions, they are held as an escrow by an attorney acting for all parties thereto. Halsbury, in fact, postulates that a document may be handed over as escrow even to a Solicitor for a party to benefit under the deed provided it is handed over to him as the agent of all parties for the purpose of such delivery.”

In Siddhivinayak Realties (P) Ltd. v. Tulip Hospitality Services Ltd, “an ‘escrow arrangement’ is normally arrived at in order to safeguard the interest of the parties for the purpose of a contract… The ‘escrow agents’, normally, are persons who are trusted by the parties of a contract under an escrow arrangement to act fairly and without bias notwithstanding their relationship with the respective parties”.

A rough analysis of the abovementioned excerpts indicates that any third-party/ stranger could be authorized as an escrow agent if the parties agree to do so. However, attorneys representing the parties are generally vested with the responsibility of keeping such documents and assets in escrow, and performing such services as directed by the parties per the terms of the tripartite agreement. Advocates may also be jointly appointed as escrow agents by the parties, as is evident from the facts of these cases.

REGULATION OF ESCROW ACCOUNTS AND ESCROW AGENTS

An Escrow account is a financial instrument which holds an asset or escrow money through a third party on behalf of and at the direction of two other parties that are in the process of completing a transaction. Such accounts can hold money, securities, funds, and other assets. While it’s an old concept globally, it has remained restricted to merger & acquisition deals. But with changing technology and the rise of internet based economy, this instrument is getting democratized with stakeholders from several sectors using it to have safe and secure transactions.

GUIDELINES ON REGULATION OF PAYMENT AGGREGATORS AND PAYMENT GATEWAYS DATED 17/03/2020

Payment Aggregators (PAs) and Payment Gateways (PGs) are intermediaries that play a vital role in facilitating payments through the online platform. PAs are those bodies who facilitate e-commerce sites and merchants in the acceptance of various payment instruments from the customers to ensure the completion of their payment obligations without the need for merchants to create a separate payment integration system of their own. They, essentially, facilitate the conjunction of merchants with acquirers while receiving payments from customers, pooling and transferring it to the merchants after a specific period of time. Further, PGs are such bodies that provide the technological infrastructure to route and facilitate the processing of an online payment transaction without any involvement in handling of funds.

Initially, pre-paid instrument (PPI) issuers and payment aggregators (PA) were required to maintain one escrow account with a commercial bank. However, the Reserve Bank of India (RBI) vide a circular dated November 17, 2020 has allowed payment companies to maintain more than one escrow account with a scheduled commercial bank with a view to diversify risk and address concerns pertaining to business continuity. Escrow Accounts are majorly regulated under Clause 8 of the dated 17/03/2020, i.e. ‘Settlement and Escrow Account Management’. The compliances to be ensured by PAs are as follows:

The amount collected by non-bank PAs is required to be maintained in an escrow account with a Scheduled Commercial Bank (SCB), and for this purpose, the operations of PAs are deemed to be designated payment systems under Section 23A of the Payments and Settlement Systems Act (PSSA), 2007

Amounts debited from the customer’s account is remitted to the bank maintaining the escrow account on Tp+0 / Tp+1 basis, where Tp is the date of charge / debit to the customer’s account against the purchase of goods / services. Similar rules shall be deemed applicable to the nonbank entities where wallets are used as a payment instrument.

Guidelines for final settlement with the merchants are effectuated by the PAs based on the following situation:

It’s the PA’s responsibility to deliver the goods or services; It would be the Merchant’s responsibility to deliver the goods or services;

and Agreement with the merchant provides for maintenance of the amount by the PA till the expiry of its refund period.

Credits towards reversed and refund transactions to be routed back through the escrow account, except when as per the contract the refund is directly managed by the merchant and the customer is aware of it.

The amount in the escrow account shall at no time be less than the collectibles from the customer or as due to the merchant.

PAs are permitted to prefund the escrow account with their own or the merchant’s funds, whereas they’re entitled to the beneficial interest on such pre-funded portion.

Escrow Account cannot be made operational for Cashon-Delivery transactions.

Certain credits/debits have been permitted to be made to the escrow account, as under Clause 8.9 of the Guidelines: “Credits: a) Payment from various customers towards purchase of goods / services; b) Pre-funding by merchants / PAs; c) Transfer representing refunds for failed / disputed / returned / cancelled transactions; d) Payment received for onward transfer to merchants under promotional activities, incentives, cash-backs etc.” and “Debits: a) Payment to various merchants / service providers; b) Payment to any other account on specific directions from the merchant; c) Transfer representing refunds for failed / disputed transactions; d) Payment of commission to the intermediaries. This amount shall be at pre-determined rates/frequency; e) Payment of amount received under promotional activities, incentives, cash-backs, etc.”

Balances outstanding in the escrow accounts of the banks shall be deemed to be part of the Net Demand Time Liabilities (NDTL) to maintain reserve requirements. The entity and the escrow account banker shall be responsible for compliance with RBI instructions issued from time to time. The decision of RBI in this regard shall be final and binding. A list of acquired merchants shall be submitted by the PAs to the banks maintaining the escrow accounts, and shall be updated in a timely fashion.

No interest shall be payable by the bank over the balances in escrow accounts, except when specifically agreed upon for the transfer of the ‘core portion’ of the minimum requisite amount, subject to certain contingencies.

Escrow Account’s balance and the core portion is to be clearly disclosed in the auditors’ certificate on a quarterly and annual basis. Securities and Exchange Board of India (Substantial Acquisition of Shares & Takeovers) Regulations, 2011: Scheduled Commercial Banks are to hold escrow accounts and act as escrow agents. Such escrow account may be in the form of: cash deposited with any scheduled commercial bank; bank guarantee issued in favor of the manager to the open offer by any scheduled commercial bank; or

Deposit of frequently traded and freely transferable equity shares or other freely transferable securities with appropriate margin. The acquirer is to create an escrow account towards the security for performance of his obligations under the SAST regulations, not later than 2 working days prior to the date of the open offer for acquiring shares is issued.

An aggregate amount has to be deposited in the escrow account as per the provided schedule. The SAST regulations, further, provide for the ways in which the disbursements would occur for different forms of the escrow accounts, as mentioned above, and the modes of their payments for consideration; etc.

Terms & Conditions for Opening of Escrow Account and Special Account by Non-Resident Corporates for Open Offers / Delisting / Exit Offers dated 24/05/2007: Acquisition / Transfer of shares shall be strictly in accordance with the provisions of Notification No. FEMA 20/2000-RB dated 3rd May, 2000 as amended from time to time and SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1997 or any other SEBI Regulations as applicable.

The accounts shall be noninterest bearing, and the Escrow Account may be opened in Indian Rupees, jointly and severally for the purpose, with the following permitted credits and debits: Permitted credits: Foreign Inward Remittance through normal banking channels; and Permitted debits: as per SEBI (SAST) Regulations or any other SEBI Regulations, as applicable.

A Special Account may be opened in Rupees, jointly and severally for the purpose, with the credit and debits as per SEBI (SAST) Regulations or any other SEBI Regulations, as applicable.

The resident mandatee empowered by the overseas acquirer for this purpose, may operate the Escrow Account in accordance with SEBI Regulations, and with the specific approval of the AD Category – I bank with whom the account is opened. No fund based / non-fund based facilities shall be permitted against the balance in the accounts.

Requirement of compliance with KYC guidelines issued by RBI shall rest with the AD Category – I bank. Balance in the Escrow Account, if any, may be repatriated at the then prevailing exchange rate (i.e. the exchange rate risk will be borne by the overseas company acquiring the shares), after all the formalities in respect of the said acquisition are completed.

In the event, the proposal under the said acquisition/ transfer does not materialize, the AD Category – I bank may allow repatriation of the entire amount lying to the credit of the Escrow Account on being satisfied with the bonafides of such remittances.

The accounts shall be closed immediately after completing the requirements as outlined above.

CONCLUSION

Escrow Arrangements are a unique tool of effectuating transactions in a smooth fashion. Escrow Accounts could prove to be beneficial for niche companies or startups by aiding them to secure their transactions based on some contingencies. As regards their specific-use transactions, such as those pertaining to procurements, supply chain, etc., such companies and businesses may leverage escrow payment methods so as to minimize the standard of risk that might exist otherwise.

An escrow mechanism facilitates efficient and safe business transactions in a manner that aids in a business’ seamless evolution. Whereas, the extensive regulatory and auditory compliances put in place by the authorities mark the determining point of its safety. The regulatory push around escrow seems to be on the right path where a more transparent online payments ecosystem is required to be created.

However, more awareness has to be ensured amongst people regarding such escrow arrangements and facilities by elucidating the function of a temporary, tripartite financial agreement that helps two parties to transact worry-free in a secure manner.

Escrow arrangements are a unique tool of effectuating transactions in a smooth fashion. Escrow

accounts could prove to be beneficial for niche companies or startups by aiding them to secure

their transactions based on some contingencies. As regards their specific-use transactions, such as

those pertaining to procurements, supply chain, etc, such companies and businesses may leverage

escrow payment methods so as to minimise the standard of risk that might exist otherwise.