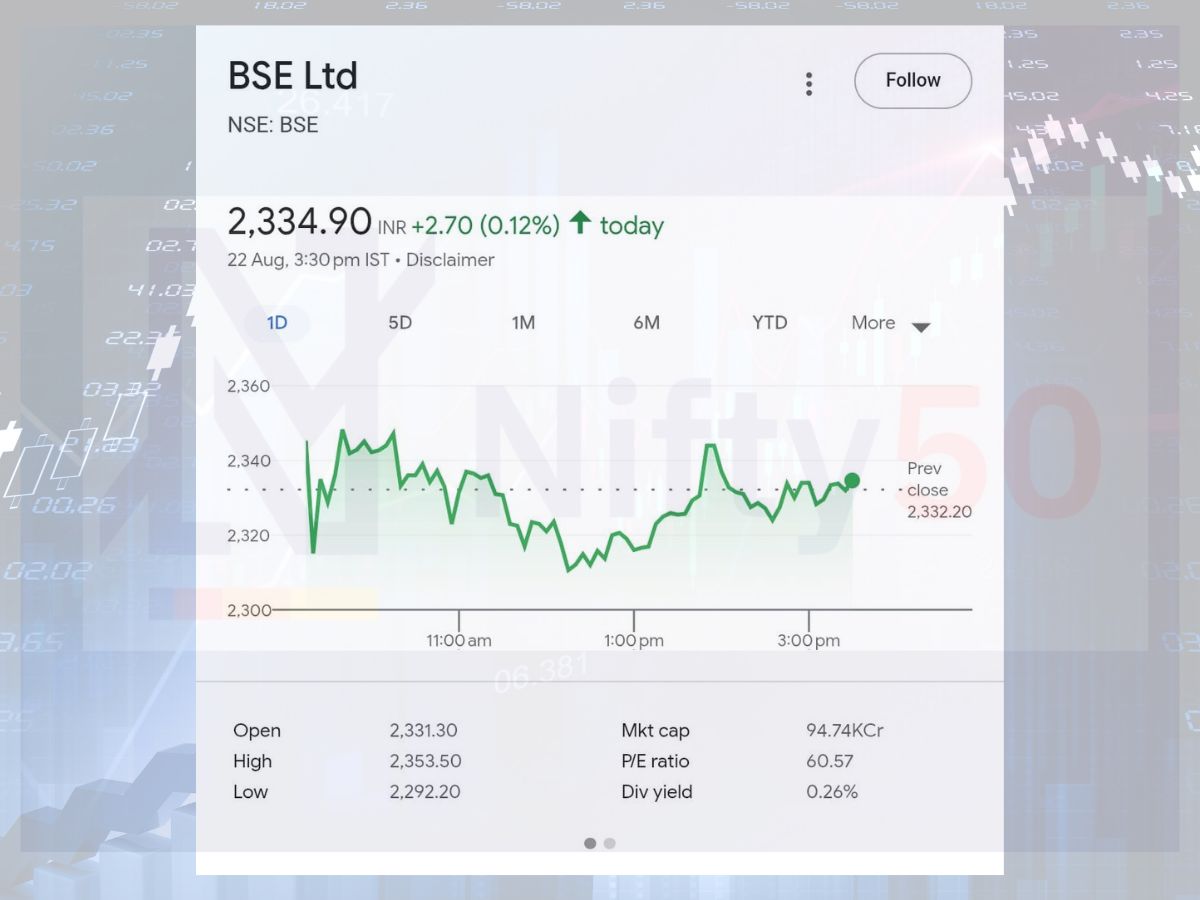

The benchmark index Nifty50 index is gearing up for a major overhaul, which would be including two stocks into the index and naturally two of the existing stocks getting replaced. The forthcoming reshuffle will see InterGlobe Aviation (IndiGo) and Max Healthcare Institute enter the index in place of Hero MotoCorp and IndusInd Bank, two veterans that have been the face of India’s automobile and banking industries for decades. Surprisingly BSE, much-anticipated by the experts as the next entry to the index didn’t make it.

The New Joiners: IndiGo and Max Healthcare

- India’s largest airline, IndiGo, has demonstrated consistent financial strength, astute fleet growth, and strong post-pandemic resurgence. Its joining of Nifty50 indicates increasing investor demand for travel and aviation, sectors that are supported by increasing discretionary spends and sustained government focus on increasing connectivity. IndiGo’s leadership also brings into focus consumer-facing sectors, as the travel boom post-COVID thrusts aviation stocks to the forefront.

- Max Healthcare Institute, one of India’s top private healthcare providers, has delivered with stable earnings growth and scalable models of business. Its inclusion in Nifty50 emphasises the growing importance of the healthcare sector, particularly with greater emphasis on medical infrastructure against elevated health consciousness. According to experts, Max Healthcare’s addition is a testament to long-term thematic bets like healthcare, gaining more institutional attention due to demographic trends and government healthcare programs.

ALSO READ | 22 August, 2025 : Stock Markets Bled, Got the Red Candle-sticks Back!

The Exit: Hero MotoCorp and IndusInd Bank

Hero MotoCorp, long the face of affordable mobility in India, leaves the index in the face of intense competition, tepid sales growth, and dislocating trends from new-age mobility players and electric vehicles. Though still a large operator, the removal of Hero reflects investor preference for firms that are continuously innovating and taking market momentum.

IndusInd Bank, another of India’s leading private sector banks, also experiences the same headwinds. Relative loan growth is behind larger peers, and asset quality pressures have detracted from performance. Exclusion by it indicates a rotation within the financial space, with the composition of Nifty50 now biased in favour of banks showing greater growth, cleaner balance sheets, and more evolved digital strategies.

ALSO READ | SBI Report Hints Slower GDP Growth Due to Global Turmoil

Implications and Market Reaction

Nifty50 reshuffle has wider market implications. Index funds and ETFs following the Nifty50 will reconstitute their portfolios, which in turn should result in short-term volatility for the concerned stocks. Historically, the stocks that are added to the benchmark indices experience higher trading volumes and buying interest as a result of passive fund inflows, and the exiting stocks could experience selling pressure from passive fund redemptions.

Tactically, all these moves are about Nifty50’s desire to replicate India’s new growth story: focusing on the growth sectors, tech progress, and businesses with scalable, customer-tailored businesses. This constant transformation is good news for investors wanting to bet on long-term, emerging trends.

ALSO READ | Implications of September Rate Cut as Fed’s Tone Smells Dovish

In short, Nifty50’s latest rejig is not just a technical overhaul, it’s a gauge of India’s changing investment scene, embracing industries that will be instrumental in the country’s growth story ahead.