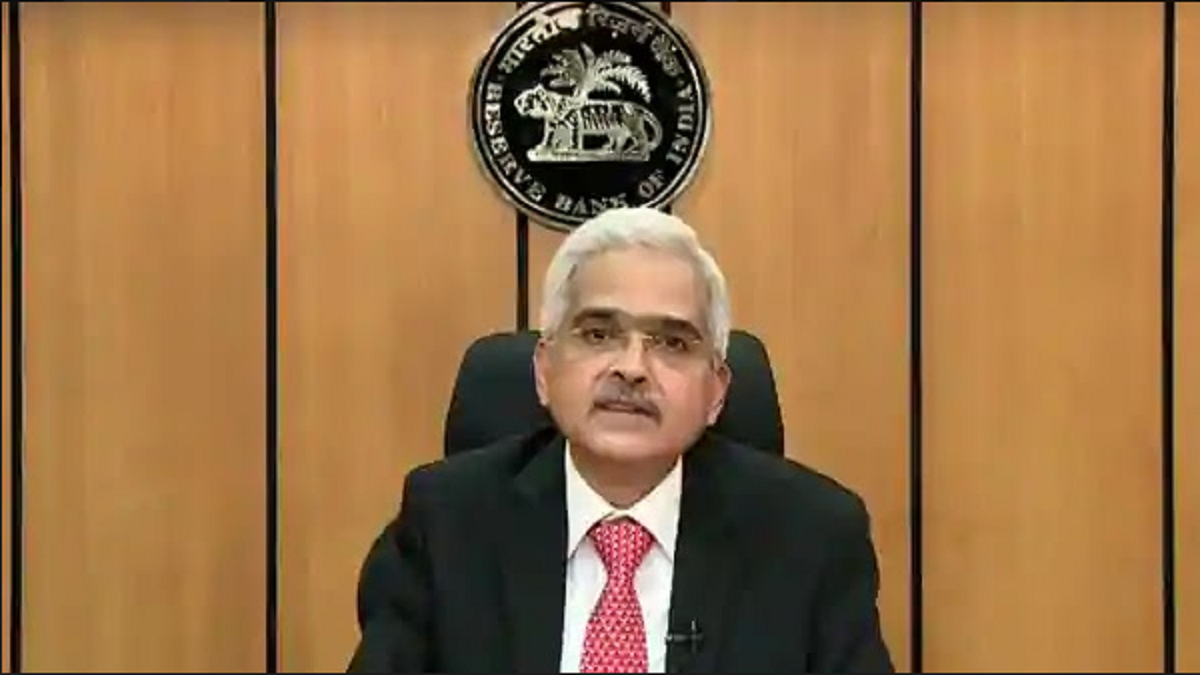

Governor of the Reserve Bank of India Shaktikanta Das urged banks and non-banking financial companies (NBFCs), among other financial institutions, to keep stress testing their books on Wednesday. The comments made today closely followed the RBI’s announcement last week that it was raising the risk weight for banks’ and non-banking financial companies’ exposure to consumer credit. This was ostensibly done to slow the rapid expansion of unsecured consumer lending.

Shaktikanta Das, while delving into various facets on the Indian banking sector as part of his address at the ‘FIBAC 2023 Conference’ organised jointly by industry body FICCI and the Indian Banks’ Association (IBA), noted that the Indian banking system continues to be resilient, backed by improved capital ratios, asset quality and robust earnings growth.

The financial indicators of non-banking financial companies (NBFCs) are also in line with that of the banking system as per the latest available data, Das remarked.

In light of this, he advised the financial institutions that it was time to improve their risk management procedures and add more safety nets in case the business cycle took a turn for the worse. “Prudential measures in the overall interest of sustainability,” was how he described the most recent increase in the risk weight move. These were preventative measures, he continued.