Shares of the Adani Group made a scorching climb on January 16, 2025, with this gain as it announced US-based investment firm Hindenburg Research to shut its doors. The announcement was made since Hindenburg had published several reports. The reports led the market value to significantly deteriorate the stock value of Adani Group during the year 2023.

Adani Power takes the Lead in the Gains.

The gainer of the day was Adani Power, whose stock had clocked Rs 599.90 after showing a great jump in value. All other Adani Group stocks too had done well. While Adani Green Energy moved 8.8% for the day to Rs 1,126.80, Adani Enterprises rose 7.7% to Rs 2,569.85. Adani Total Gas did equally well as the scrip rose 7% for the day to Rs 708.45.

This rally also extended to Adani Energy Solutions, which rose 6.6% to Rs 832.00, and Adani Ports, which moved up 5.5%, closing at Rs 1,190. Ambuja Cement gained by 4.5% at Rs 542.80. Adani Wilmar was much smaller at a gain of 0.5%.

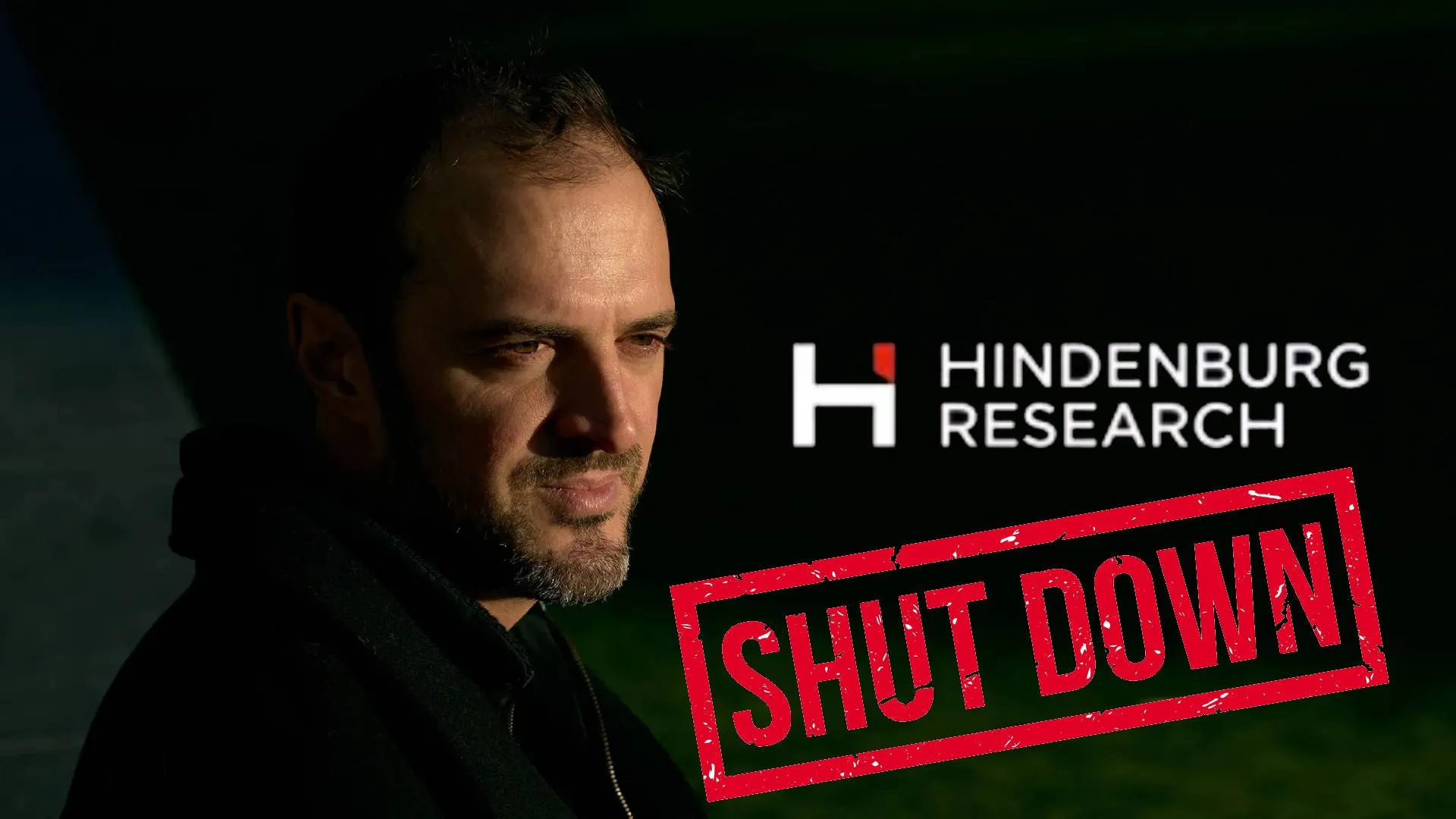

Hindenburg Research Closes Down Under Controversy

The stock market surge followed the unexpected announcement by Hindenburg Research. The firm that had previously published controversial reports targeting Gautam Adani’s business interests. The reports contributed to substantial financial losses and a significant reduction in market value for the Adani Group last year. Despite this, the group had gradually recovered much of its losses.

Hindenburg Research founder Nathan Anderson announced on January 16 that the firm would shut down after it completes its current investigations, which are now focused on Ponzi schemes. The decision to close the research firm comes after significant political and financial pressure, especially after a member of the House Judiciary Committee requested the Department of Justice to retain all records related to investigations into the Adani Group.

Resilience in Turbulence of Adani Group

The reports of Hindenburg have therefore been causing a ruckus, but their answer is an abode of innocence. The conglomerate rejected all of the allegations levied by the firm which were deemed to be wrong. The Adani Group has worked hard to regain its image and get the attention of investors back in the previous time..

The announcement of Hindenburg’s closure marks a key moment for the Adani Group. It signals an end to one of the most publicized corporate battles in recent memory. The news is especially significant for Gautam Adani, whose empire has faced both market challenges and public scrutiny.

Final Thoughts on Hindenburg’s Impact

The disbandment of Hindenburg Research is a notable event for both the Adani Group and the financial industry. Hindenburg’s reports triggered a storm of regulatory investigations and market turmoil, particularly affecting Adani’s business interests. While the Adani Group’s stocks have surged following the closure announcement, questions remain about the broader impact of these developments on the global business community.

Despite the turbulent past year, the Adani Group seems to be on a recovery path, and the closure of Hindenburg Research might pave the way for a less contentious future for the conglomerate.