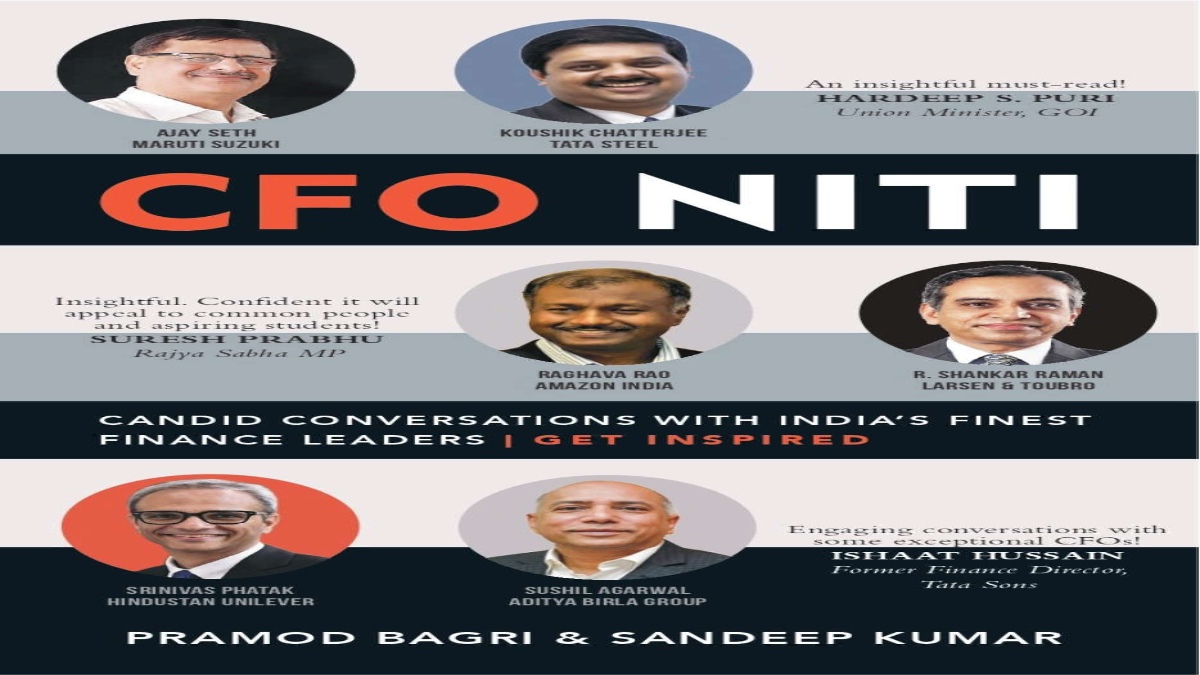

Are you intrigued to know what it takes to run India’s biggest finance units? If so, then you can have a peek inside the Chief Financial Officer’s (CFO’s) office and how their offices function through ‘CFO Niti: Candid Conversations with India’s Finest Finance Leaders’ (published by Konark Publishers). The book offers detailed insight into their personal growth stories and the progression of the finance industry in the past decade. In an e-mail interview, Pramod Bagri and Sandeep Kumar share why they chose to interview CFOs and the fascinating details they uncovered during the process. Excerpts:

Pramod Bagri

Pramod Bagri

Q. When and how did you first became interested in writing?

A. As part of large consulting organisations, we have been writing domain-related articles for the past few years, generally posted on internal portals like Linkedin, and others. We have been also fortunate to work with CXOs of Fortune 100 companies and learn from them directly. With this book, we intended to reach out to a wider audience and help them get mentorship directly from industry leaders.

Q. Tell us about your book ‘CFO Niti: Candid Conversation with India’s Finest Finance Leaders’. When and how did you two plan to write this book?

A. ‘CFO Niti’ brings you a never-before-seen view of the CFO office and the leaders running India’s biggest finance units. It brings to the readers the detailed stories of these CFOs—their personal journey, insights into how the CFO’s office functions, and their perspectives on the rapid evolution of the CFO’s office in the past decade. You also have access to their daily routines, their reading list, their inspiration areas, what they look for in their talent, and many more interesting tit-bits. We have captured discussions with CFOs of Maruti Suzuki, Tata Steel, Amazon India, Larsen & Toubro, Hindustan Unilever, and Aditya Birla Group.

We started working on this book in 2018. Like most great things in life, this book was more of a confluence of multiple happenstances than a planned exercise. At a chance discussion, both of us (Sandeep and Pramod) debated on the importance and prominence of the CFO office. While we both agreed on its importance, we were not too certain of the prominence it has today within large organisations. Out of curiosity, we ran a search for the most important CFOs, and what we found was a bit surprising. About 90% of the content was focused on the Chief Executive Officers (CEOs) and their leadership styles. Another 9% was on the Chief Marketing Officers (CMOs), Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and others. The CFOs were mentioned very few times, a lot less than the other CXO group. Next, we searched on Amazon for books on CFOs; the results were even more despairing. It was a bit strange that there was not enough content on this topic.

We thought this wouldn’t do at all. Most large organizations, with strong finance functions, have a whole bunch of staff aspiring to be the CFO. All the newly minted Chartered Accountants and Masters in Business Administration (MBAs) in finance have the dream of making it to the vaunted CFO position one day. They could all do with some knowledge about the role and the people who occupy it. Why hasn’t anyone bothered to put together some insights around how the CFO office functions, what makes a successful CFO, some inspirational stories about their lives, and many such instances of CFOs lives that are worth being discussed. This small discussion led to an effort to find India’s most important CFOs heading the largest, most profitable, and impactful organizations, and chart out their life stories across multiple parameters. The aim was to not only figure out the secret sauce that went into the making of a successful CFO, but also understand their personal lives in detail; what values drive the CFOs, and what are the common factors that bring success in this role. This book would act as a guide to a student or a mid-career professional to understand what key elements they should inculcate in their careers and eventually target this coveted position.

Q. You have mentioned in the introduction of your book why you chose to write on CFOs over CEOs. Would you like to elaborate on why you chose to write a book specifically on CFOs and not on other C suite roles like CTO, CIO, or others?

A. There are three reasons why we chose to write about Chief Financial Officers. First, there was and remains a demand-supply gap. There is far lesser content available on this topic than the requirement and the number of people who are interested in understanding and creating a better finance function. Apart from the usual suspects like finance professionals aspiring to someday become the CFO, finance students looking to chart out their careers, and business leaders wanting to create a best-in-class CFO Office, we wanted general readers to get inspiration from the growth stories of these industry leaders. We recently did an event for Ortho TV attended by a large number of doctors and were surprised to find the level of curiosity and enthusiasm to derive learnings from the book and improve the functioning of their organisations.

Second, the CFO office has undergone a sea change in the past few years compared to other functions. From being considered bean counters responsible for accounting and reporting, the CFO office has transformed to become the nerve centre of decision-making in large corporates. CFOs now are equal partners to business teams and contribute wholeheartedly to business growth and not act as watchdogs only. As you will find in the book, there are several anecdotes and paradigms (e.g., “Fly-on-the-wall test) where CFOs have themselves spoken about how their roles have transformed over years. This needs to be highlighted so that smaller organizations and entrepreneurs can look at the best practices and imbibe and implement the same. Third, both of us are students of finance and have worked with CFOs all our professional careers. Unlike our daredevil CFOs who are supremely comfortable with stepping out of their comfort zones, we opted to stay in our circle of competence!

Q. While you were planning your list of CFOs to contact, were there any female CFOs on the list? Didn’t you think of including any female CFO in your book?

A. There is no denying that women are underrepresented in this important role, not only in India but globally. We did reach out to the ones spearheading large organisations, but due to varied reasons, it did not materialise. We will ensure their presence in the next series.

Q. Were there any surprising details you guys uncovered during the interview process?

A. You will find the most surprising details in the early lives of these leaders:

o A CFO who started his career as a cash counting resource in the Reserve Bank of India (RBI).

o Someone who almost made Molotov cocktails at the age of 18. We are not telling who!

o A CFO who aspired to be a doctor and another who wanted to be a fashion designer

We have tried our best to give a feeling of “Mentor by your side” by preserving individual voices and not homogenising or editing everything. We also included sections like “Extra shots” that capture the way users can apply these learnings, key takeaways (perforated pages and can be torn and pasted to your desk), photographs capturing the journey, and final thoughts that summarise the secret sauce to becoming a successful finance leader as well as how each of these conversations has enriched our lives.

Q. In your book, you have discussed how much this book is going to be helpful for the young aspirants who aspire to enter and work in the financial sector. Nowadays, we are witnessing financial consciousness among people, do you think your book is going to be helpful for such people in any way?

A. Given the higher levels of financial consciousness among the millennials, it is even more imperative for them to understand what it takes to build a sustainable large business and what role an effective finance team plays in it. This book allows our readers to reflect on and learn from these leaders, not only regarding finance but overall personal and professional growth. Learnings like “Safety-Liquidity-Return” while investing, “Never waste a crisis” and many more lessons can be applied to one’s financial wellbeing. The book is written in an easy and lucid style without any jargon and we have several reviews from non-finance readers who have come back and shared their key takeaways from the book and how it helped them.

Q. Was there a specific person’s story with whom you could relate very much? What were the key learnings?

A. Each CFO’s story is different and the key learnings are varied. We were lucky to have early access to these conversations and both of us have very different life views than what we had when we started. We started this book with an objective—to contribute to the larger community and act as a bridge between this untapped sea of knowledge and the beneficiaries. However, we ended up receiving a personal transformation as we heard these leaders detail out their life journeys, lessons, and roles. While we have been closely interacting with global CFOs as part of our roles, these interactions opened our eyes to a completely different world of theirs. After many of these interviews, we spent hours reflecting on deep life lessons we just witnessed. We were able to instantly achieve improved results in our own professional lives by applying some of these lessons. We firmly believe ‘CFO Niti’ will have the same impact on the lives of its readers.