A. The genesis of Multilateral Instruments

A.1. Introduction

Multinationals (“MNCs”) operates in various countries, and such entities may be taxed both the countries, i.e. country of their residence as well as the source country. Countries enter into treaties to avoid double taxation in the source as well as resident countries. Such treaties are generally referred to as Double Taxation Avoidance Agreements (“DTAAs”). More than 3000 DTAAs are currently in effect, and the numbers seem to be growing with time.

The DTAAs are generally structured on the UN Model or the OECD Model or combination of both these models. The fundamental difference between these models is that unlike OECD Model, the UN Model is skewed more in favour of the source countries (Country where the source of income lies) and is generally preferred by the developing countries. However, the common basis of both the model is that the source country should get the fair share of its taxes and such taxes paid in the source country are available as a credit to the taxpayer in the country of its residence.

MNCs often structure their operations in a tax-efficient manner to enjoy favourable tax positions between contracting parties to the DTAAs. Any enterprise may either have active income (business income) or passive income (dividends, interest or capital gains). The structuring includes Treaty Shopping, Excessive use of debt over equity, Abuse of Transfer Pricing Provisions, Use of Tax Havens etc. For example: Interposing entities in low tax jurisdictions to avoid taxation of passive incomes or organizing the operation in the source country in such a manner to eschew creation of Permanent Establishment and consequently avoid taxation of active incomes. Such interposing of entities or organizing of operations without commercial substance had been a matter of concern for the contracting parties to a DTAAs as interposing of such entities lead to erosion of tax base as contemplated by the contracting parties. Sometimes mere structuring leads to double non-taxation of incomes. It is in this backdrop, the OECD, along with some other countries, took up a project in 2013 to avoid such erosion of tax base. This Project is popularly known as Base Erosion and Profit Shifting (“BEPS”). The resulting program provides governments with domestic and international instruments better-aligning taxation with economic activity and value creation.

A.2. BEPS

BEPS is a term commonly used to refer to notorious tax avoidance strategies, which taxpayers use to shift their profits from high tax jurisdictions to low or no-tax jurisdictions, to minimize their tax burdens. Such strategies revolve around exploitation of mismatches between different tax laws of different countries. The idea to deal with BEPS dates back to the year 2013 when the OECD issued a report titled ‘Addressing Base Erosion and Profit Shifting’. Following the release of this report, multiple nations (including OECD member nations and the G20 nations including India) adopted a 15-point Action Plan to address the BEPS bugbear, with a deadline of 2015. This resulted in the release of the final BEPS reports, in 2015, on each of the 15 categories identified in the BEPS Action Plan. Such reports seek to purge double non-taxation, annihilate treaty-abuse and ensure that profits are taxed in the jurisdiction of value creation.

The following are the fifteen action plans envisaged to curb the base erosion and shifting of profits from one tax jurisdiction to others:

Action 1 Addressing the Tax Challenges of the Digital Economy

Action 2 Neutralising the Effects of Hybrid Mismatch Arrangements

Action 3 Designing Effective Controlled Foreign Company Rules

Action 4 Limiting Base Erosion Involving Interest Deductions and Other Financial Payments

Action 5 Countering Harmful Tax Practices More Effectively, Taking into Account Transparency and Substance

Action 6 Preventing the Granting of Treaty Benefits in Inappropriate Circumstances

Action 7 Preventing the Artificial Avoidance of Permanent Establishment Status

Actions 8-10 Aligning Transfer Pricing Outcomes with Value Creation

Action 11 Measuring and Monitoring BEPS

Action 12 Mandatory Disclosure Rules

Action 13 Transfer Pricing Documentation and Country-by-Country Reporting

Action 14 Making Dispute Resolution Mechanisms More Effective

Action 15 Developing a Multilateral Instrument to Modify Bilateral Tax Treaties

As can be seen, the actions plan ranges from prevention of erosion of tax base to enhancement of international cooperation on the emerging issues as well the ways of implementing the same. The BEPS project suggested inclusion of Principle Purpose Test (“PPT”) and Limitation of Benefit Clause (“LOB”) to identify the genuineness and substance of a transaction and an entity. These suggestions are aimed at reducing avoidance of tax on passive incomes. The recommendations have lowered the bar for creation of Permanent Establishment to minimise avoidance of tax on business incomes. The OECD described the final BEPS reports as containing recommendations that fall in following different categories:

Agreed minimum standards

Reinforced international standards

Common approaches and best practices for domestic law

Analytical reports

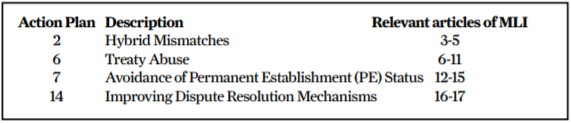

A Multilateral Instrument (“MLI”) is developed to implement tax treatyrelated measures of the BEPS Project. The OECD/ G20, through MLI, has implemented the outputs of four action plans out of the 15-point action plan under the BEPS Project (Discussed below). For the implementation of remaining action plans, BEPS suggested changes in the domestic laws.

A.3. Changes made by India

Even before the onset of BEPS, India had introduced General Anti Avoidance Rules (“GAAR”). GAAR provisions gave extensive powers, even to override tax treaty benefits if the tax department is of the view that any transaction or arrangement is made with the primary purpose of obtaining a tax benefit. However, these changes have been given effect from the fiscal year only.

GAAR were introduced in Indian tax law to catch all schemes of tax avoidance in general under Chapter X-A of Income Tax Act, 1961 (“the Act”). It is effective from 1st April 2017, i.e. the Assessment Year 2018-19. GAAR reflects ‘substance over form principle’ and consist of a broad set of rules based on general principles to counter potential tax avoidance. Among other things, GAAR provisions can be applied to deny tax treaty benefits to a non-resident taxpayer who would be otherwise eligible to benefit through treaty abuse.

GAAR can be invoked in case of an Impermissible Avoidance Arrangement (IAA), if there is no business purpose or commercial expediency except to obtain a tax benefit, GAAR may be invoked.

Further, without waiting for the final BEPS proposals; India made changes in its domestic law like the (i) introduction of the concept of significant economic presence to tax foreign entities if they cross certain thresholds and (ii) introduction of equalization levy. Further modulated Thin Capitalization rules were introduced to restrict the claim of interest expenditure from the income taxable in India. MNCs were further obligated to maintain Master file as well as a local file of their worldwide operations so that the tax department can identify as to whether the entity is offering its income in proportion to its functions, assets and risk employed in India. Such changes find their place in the BEPS report.

B. MLI-Outcome of Action 15 of BEPS

B.1. What is MLI?

The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting is one of the outcomes of the OECD/ G20 Project to tackle BEPS. An MLI is developed to implement tax treaty-related measures of the BEPS Project. MLI does not replace existing DTAA provisions but is to be referred along with a DTAA. The Action Plan 15 of BEPS Report, “Developing a Multilateral Instrument to Modify Bilateral Tax Treaties”, concluded that a multilateral instrument, providing an innovative approach to enable countries to modify their bilateral tax treaties swiftly. With over 3000 treaties being functional today, a treaty by treaty amendment for implementation of these measures would have been cumbersome and practically impossible without the risk of inconsistencies. Thus, a single instrument with pervasive applicability was conceptualised and thus arrived the MLI.

Action 15 of the BEPS suggested entering into MLI where the participating country, may merely be required to give their consent on various Articles of MLIs broadly instead of negotiating a treaty with all the treaty partners. If the consent given by India over a particular Article overlaps with the consent given by another partner country, then only it can be said that both the countries have agreed to amend their Tax Treaty. After the OECD ratifies such overlapping, a notification is issued by India notifying such changes. Once a notification is issued, the tax treaty is modified in terms of MLI, and an MLI synthesized text of Tax Treaty is published. The main objective of MLI is to alter the DTAA’s with one agreement rather than negotiating the DTAA on a bilateral basis which may take many years or decades. MLI is not a substitute to DTAA but acts as an adjunct document.

The OECD/G20, through MLI, has implemented the outputs of 4 action plans out of the 15-point action plan under the BEPS Project. The 4 action plans which MLI seeks to address are as under:

It may be noted that keeping the MLI relevant to the object of the BEPS project; there are certain minimum standards to which all the participating countries had to agree. Such minimum standards include Principal Purpose Test, etc.

B.2. Principal Purpose Test: Article 7 of MLI

Article 7: Principal Purpose Test is a Minimum Standard requirement. As per the PPT treaty, the benefit shall be disallowed if it is reasonable to conclude having regard to all relevant facts and circumstances that one of the principal purpose an arrangement or transaction was obtaining the treaty benefit. However, if it is established that granting that benefit in these circumstances would be in accordance with the object and purpose of the DTAA; in such case, the treaty benefits shall not be disallowed. The benefit covers all limitation on taxation like tax reduction, exemption, deferral, tax reduction, the benefit of tax sparing, Underlying Tax Credit etc.

C. Beneficial to India

With the spread of COVID pandemic throughout the world and with China’s expansionist agenda, many countries including the United States does not have excellent trading relations with China and are willing to shift their manufacturing bases out of China and sees India as an attractive investment location. Therefore, considering the object of BEPS and MLI as aligning taxation with the value creation, India is likely to significantly benefit from MLIs as it as the significant value addition in the supply chain may take place in India, and it would generate substantial tax revenue for India.

D. Tax Uncertainty D.1. Interpretation of DTAAs

With the applicability of MLI on Indian tax treaties with effect from 1st April 2020 all the DTAAs stand automatically affected. Interpretation of tax treaty shall pose a great deal of difficulty since the tax treaties need to be read together along with MLI text, MLI position of the other partners etc.

D.2. The interplay of PPT and GAAR under domestic law

PPT rule is compendious in its scope than GAAR. “One of the purpose” threshold under PPT is broader than “Main Purpose” under GAAR, the threshold limit under PPT is lesser than the GAAR. Tax treaty benefit under PPT can be denied if one of the purposes of the arrangement is to obtain a tax benefit. However, in the case of GAAR to deny a benefit, it requires fulfilment of twin condition of main purpose test and tainted element test. A structure which passes the PPT test may pass the GAAR test as well. In other words, by qualifying in one test of MLI, the risk of invocation of GAAR is obliterated.

The scope of GAAR is expansive as compared to PPT since GAAR applies to all forms of abuse of tax provision; domestic as well tax treaty benefit whereas PPT rule applies only in the case of treaty abuse.

GAAR provisions can be invoked if the tax benefit exceeds Rs.3 crores; however, no such limit has been provided in case of PPT.

As per section 90 of the Act, provisions of domestic tax law apply to the extent they are more beneficial than the tax treaty. Therefore, in a situation where a taxpayer is likely to fail PPT, he may seek to cover himself under GAAR on the contention that provisions of domestic GAAR (having a threshold) is more beneficial than PPT. However, one cannot lose sight that GAAR provisions override the provisions of the Act, including section 90 of the Act.

GAAR provides for grandfathering of investments acquired before 1st April 2017, however, PPT does not provide for grandfathering provisions hence once MLI becomes effective even transfer of past investments made before 1st April 2017 may be subject to PPT although grandfathered under GAAR.

The safeguard provided by GAAR in the form of Approving Panel is absent in case of PPT. There is no separate panel or authority to decide whether a transaction or arrangement has passed the PPT test required by the tax treaty.

Unlike PPT, the burden of proof under GAAR is on the department. Hence the assessment officer will likely refuse treaty-related benefit on the reasonable belief that the PPT requirement under the tax treaty has not been fulfilled and it for the Assessee to prove otherwise.

One of the purposes of both GAAR and PPT is to prevent abuse of treaty benefit, and hence there may arise a conflict between them in the course of application. The conflicts which may occur between GAAR and PPT application may give rise to various litigations and need to be settled by the judiciary.

E. Conclusion

Anti-abuse provisions would serve the desired purpose only if they are applied in true spirit and invoked only in case of genuinely abusive or artificial arrangements. Both PPT and GAAR will irrefragably increase the documentation requirements for justification of commercial expediency or business rationale of a transaction or arrangement otherwise it may result in protracted litigation.

Adv. Gagan Kumar, a Chartered Accountant and Advocate practices as an Arguing counsel at the Supreme Court & Delhi High Court. He is the founder of Krishnomics Legal practising in the areas of Arbitration, Bankruptcy / Insolvency, Breach of Contract, Corporate, Customs & Central Excise, GST, Media and Entertainment, Startup, Tax.