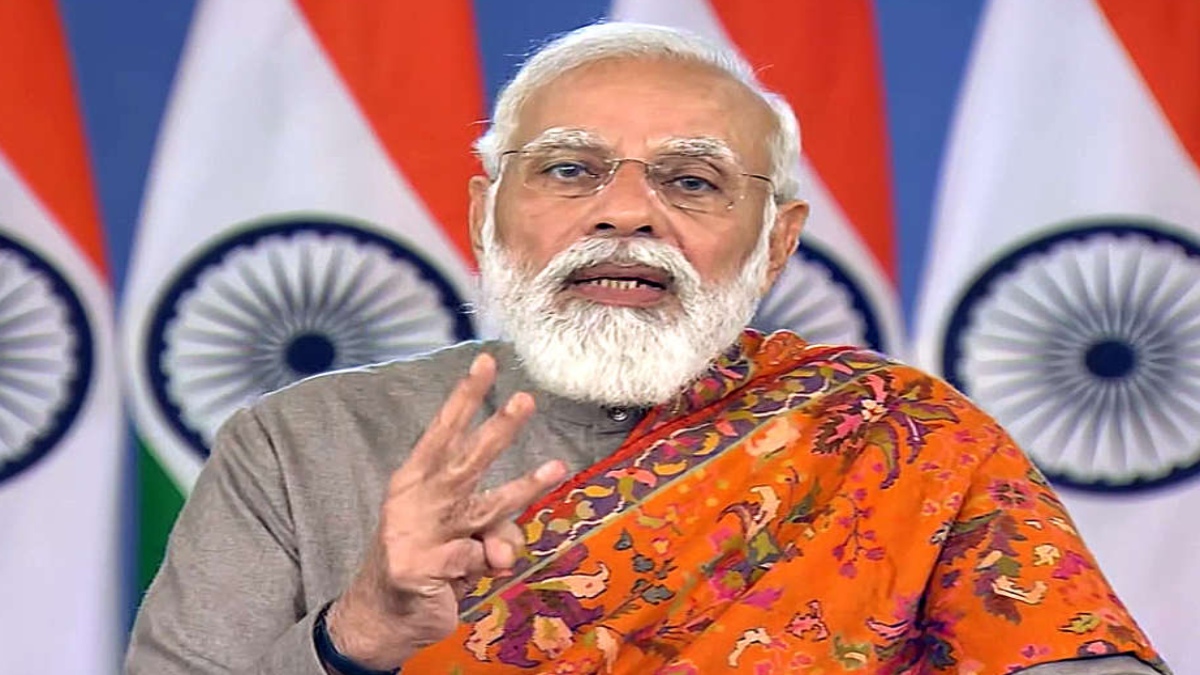

“Jan Dhan signifies our determination to end financial untouchability and attain freedom from poverty”

— Prime Minister Narendra Modi

Pradhan Mantri Jan-Dhan Yojana (PMJDY) was launched on 28 August 2014, with the objective to ensure accessibility to various financial services like availability of basic savings bank account, need based credit, remittance facility, insurance, micro-credit and pension to the excluded sections, that is, the weaker sections and low income groups. This deep penetration at affordable cost is possible only with effective use of technology and for this massive step towards financial inclusion, the credit goes to the Modi government. PMJDY is a national mission on financial inclusion encompassing an integrated approach to bring about comprehensive financial inclusion of all the households in the country. The plan envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension facility. In addition, the beneficiaries

get RuPay Debit card, having inbuilt accident insurance cover of Rs 2 lakh. The plan also envisages channeling all government benefits from Centre, state, and local bodies, to the beneficiary accounts and pushing the Direct Benefits Transfer (DBT) scheme of the government. The technological issues like poor connectivity and glitches in on-line transactions have been effectively addressed in mobile transactions in the last seven years. In fact, technology has been used befittingly as a big enabler, something that never happened meaningfully, prior to 2014. Also, an effort is being made to reach out to the youth of this country to participate in this program on a mission mode basis.

Prime Minister Narendra Modi’s Digital India, lays out three broad outcomes for technology. These are, technology to transform the lives of citizens, to expand economic opportunities and to create strategic capabilities in certain technologies. Former PM Rajiv Gandhi had said that in India from the 80s, out of 100 paise of benefits, only 15 paise reached the true beneficiary. The remaining 85 paise was gobbled up by middlemen and sarkaari babus. Thanks to Modi’s Digital India, 100% of all benefits reach the beneficiary through DBT. The success of this transformation lies in the vision of PM Modi, in the application of technology, by making use of Aadhaar that has plugged all leakages from the system, eradicated middlemen and prevented endemic corruption that was India’s bane under successive Congress regimes, for decades together.

Savings made to public exchequer owing to use of Aadhaar and DBT, primarily due to weeding out of fake and duplicate beneficiaries, have been estimated to be to the tune of over Rupees 2.24 lakh crore.

In Uttar Pradesh alone, benefits of over Rs 2.8 lakh crore (cumulative) have been transferred directly into the accounts of beneficiaries. A total of around 15 crore people in UP have benefitted under the various Central/State government schemes through the DBT, by leveraging Aadhar. Therefore, Aadhar is not just the world’s biggest digital identity programme but also a tool for empowering people by securing their entitlements.

Talking about Aadhaar, over 313 central government schemes have been notified to use Aadhaar for leak-proof delivery of various social welfare benefits like PM-KISAN, PM Aawaas Yojana, PM Jan Arogya Yojana, PAHAL, MGNREGA, National Social Security Assistance Programme, PDS, and the like. Aadhar coupled with PMJDY and Mobile (JAM Trinity) have created a robust platform for accelerating financial inclusion. Aadhar enabled payment services are providing easy access to banking services by use of fingerprint authentication. India has developed tremendous capabilities under the Digital India programme started by the PM Modi in 2015. The indigenously developed CoWIN portal, which has ensured over 155 crore vaccinations that have been given till date, is a model that has been praised globally and is now being emulated by other countries too. It is a vindication of how India has bridged the digital divide, by making financial inclusion and last mile delivery, workable concepts. The Covid management of the UP government as it successfully leveraged technology by tapping a network of around 1.5 lakh Common Services Centre (CSCs) and 4.5 lakh Village level Entrepreneurs (VLEs), to facilitate over 20 crore vaccinations in UP, which is over six times the population of Australia, is a sterling example of digital inclusion by the Modi-Yogi, double engine sarkaar. With the recently commissioned Aadhaar Seva Kendras (ASKs), in addition to the existing ones, at Gonda, Varanasi, Saharanpur, and Moradabad, the citizens of UP will witness the march towards a “Digital Uttar Pradesh”, more swiftly than ever before.

Last year, the proposal to provide monetary assistance to 11.8 crore students (118 million students) through DBT, of the cooking cost component of the “Mid-Day-Meal Scheme”, to all eligible children, as a special welfare measure, is yet another example of digital empowerment. This proposal was in addition to the Modi government’s announcement of distribution of free-of-cost food grains at Rs 5 per Kg, per person, per month, to nearly 81 crore beneficiaries under the Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY).

This decision/proposal will help in safeguarding the nutritional levels of children and aid in protecting their immunity during the challenging pandemic times. The Modi government will provide additional funds of about Rs 1200 crore to State governments and UT administrations for this purpose. This one-time special welfare measure of the Union government will benefit about 11.8 crore children studying in class I to VIII, in the 11.20 lakh government and government aided schools, across the country.

Coming back to Jan Dhan, more than 44.34 crore beneficiaries banked under PMJDY since inception, amounting to a whopping sum of over Rs 1.55 lakh crore. Over 1.26 lakh Bank Mitras, became a part of the Jan Dhan Yojana scheme, to ensure it reached India’s remotest and the poorest. PMJDY Accounts have grown over three-fold from 14.72 crore in March 2015, to 44.34 crore, as on date.

Over 55% Jan-Dhan account holders are women and over 67% Jan Dhan accounts are in rural and semi-urban areas, showcasing PM Modi’s unwavering commitment to last mile delivery. Out of total 44.34 crore PMJDY accounts, well over 86% are operative, busting the myth peddled by the Opposition, that PMJDY is a dormant scheme. Total RuPay cards issued to PMJDY account holders stand at over 31.23 crore.

Under PM Garib Kalyan Yojana, a sum of over Rs 30,945 crore was credited into accounts of women PMJDY account holders during the Covid lockdown. Over 8 crore PMJDY account holders have received direct benefit transfer (DBT) from the Modi government under various welfare schemes, at some point or the other. Overall, till date, over Rs 18 lakh crore has been disbursed via the DBT to the needy, under the aegis of the Modi government, which is not a mean achievement by any yardstick.

Banking the Unbanked pertains to opening of basic savings bank deposit (BSBD) account with minimal paperwork, relaxed KYC, e-KYC, account opening in camp mode, zero balance, and zero charges. Securing the Unsecured pertains to issuance of indigenous Debit cards for cash withdrawals and payments at merchant locations, with free accident insurance coverage of Rs 2 lakh. Funding the Unfunded pertains to other financial products like micro-insurance, overdraft for consumption, micro-pension, and micro-credit. Jan Dhan accounts opened are online accounts in core banking system of banks, in place of the earlier method of offline accounts. Interoperability through RuPay debit card or Aadhaar enabled Payment System (AePS), have been force multipliers.

The Modi government decided to extend the comprehensive PMJDY program beyond 2018 with some modifications. Focus shifted from ‘Every Household’, to Every Unbanked Adult’. Free accidental insurance cover on RuPay cards was increased from Rs 1 lakh to Rs 2 lakh for PMJDY accounts opened after 28 August 2018. Enhancement in overdraft (OD) facilities was enabled, with OD limit doubled from Rs 5,000 to Rs 10,000 and with OD upto Rs 2000, given without conditions. The upper age limit for OD was also raised from 60 to 65 years.

PMJDY has been the foundation stone for people-centric economic initiatives. Whether it is direct benefit transfers, Covid-19 related financial assistance, PM-KISAN, increased wages under MGNREGA, life and health insurance cover, the first step of all these initiatives is to provide every adult with a bank account, which PMJDY has been doing on a war footing. One in two bank accounts opened between March 2014 and March 2020, was a PMJDY account. Within 10 days of nationwide lockdown, more than 20 crore women PMJDY accounts were credited with ex-gratia. Jan Dhan provides an avenue to the poor for bringing their savings into the formal financial system, an avenue to remit money to their families in villages besides taking them out of the clutches of the infamous, usurious money lenders. PMJDY has brought the unbanked into the banking system, expanded the financial architecture of India, and brought financial inclusion to almost every adult. In today’s Covid-19 times, we have witnessed the remarkable swiftness and seamlessness with which Direct Benefit Transfer (DBTs) have empowered and provided financial security to the vulnerable sections of society. An important aspect is that DBTs via PM Jan Dhan accounts have ensured every rupee reaches its intended beneficiary, by preventing systemic leakages. Needless to add that, zero tolerance for corruption is not just a slogan or a platitude but an abiding work ethic for the Modi government, with the concept of “Integral Humanism”, embedded in every welfare measure that PM Modi has so tirelessly worked towards relentlessly, in the last seven years.

Financial inclusion is a national priority of the Modi government, as it is an enabler for holistic growth The journey of PMJDY led interventions undertaken over a short span of seven years have in effect, produced both transformational as well as directional change, thereby making the emerging financial ecosystem, capable of delivering financial services to the last person of the society and the poorest of the poor. The underlying pillars of PMJDY, namely, Banking the Unbanked, Securing the Unsecured, and Funding the Unfunded, have made it possible to adopt a multi-stakeholders’ collaborative approach, while leveraging technology for serving the unserved and underserved areas as well. No government in post Independent India has embraced Welfarism, within the larger framework of a Capitalist order, as seamlessly as the Modi government and that speaks volumes about PM Modi’s commitment to a socio-economic order that encourages all three—egalitarianism, free markets, and competition.

Sanju Verma is an Economist, National Spokesperson of the BJP and the Bestselling Author of ‘The Modi Gambit’.