The National Payments Corporation of India (NPCI) has hiked the Unified Payments Interface (UPI) transaction limits from September 15, 2025 significantly. This action aims to promote higher-value digital transactions and respond to the increasing market demand for end-to-end bigger transactions among different consumer and business segments.

ALSO READ | 8th Pay Commission: Possible DA Hike | Latest News Updates

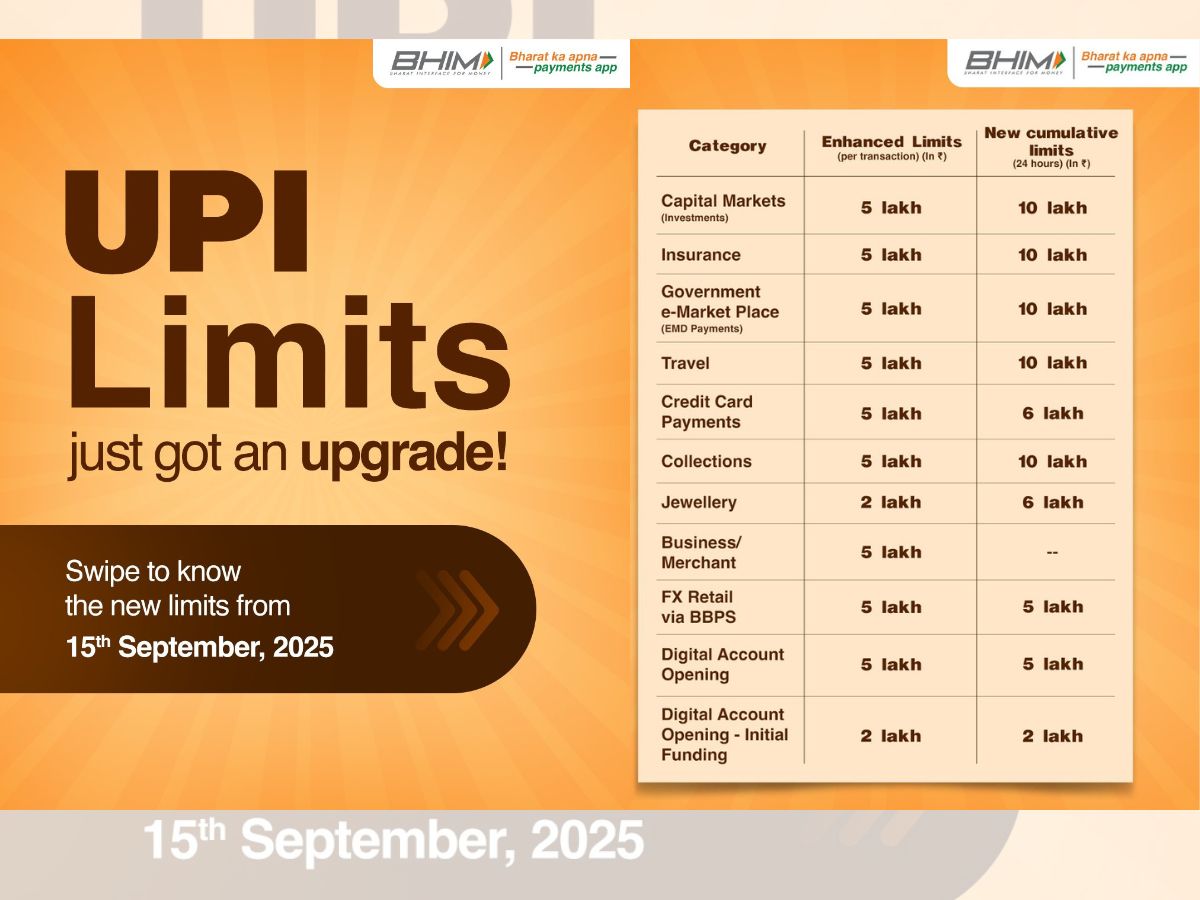

Enhanced UPI Limits across Different Segments

Under the new structure, chosen authenticated merchant categories will have a significant hike in their transaction amounts, allowing users and companies to make higher-value payments more easily. The most important revised per-transaction and daily aggregate limits are as follows:

- Capital Markets and Investments: The per-transaction limit is increased from ₹2 lakh to ₹5 lakh, with a daily limit of ₹10 lakh. This will allow investors to make larger amounts in stock market investment, mutual funds, and payment to AMCs without splitting payments.

- Insurance Premiums: The transaction limit has been raised to ₹5 lakh per transaction, with a ₹10 lakh per day limit. With this development, customers can pay higher premiums or multiple insurance policies through UPI with ease.

- Government e-Marketplace (GeM): For transactions such as payment of tenders and tax payments, the limit is now ₹5 lakh per transaction and ₹10 lakh per day, an improvement from the previous ₹1 lakh limit.

- Travel Sector: Travel-related payments—bookings, tickets, and related expenses—can be made up to ₹5 lakh per transaction and ₹10 lakh daily, significantly higher than the previous ₹1 lakh limit. This will simplify high-value travel bookings digitally.

ALSO READ | Gold Price: Why are the Gold Rates Increasing Around the World?

- Bill Payments through Credit Cards: Credit card bills can be paid up to ₹5 lakh per transaction with a limit of ₹6 lakh per day, a huge hike increasing the convenience for high-end credit card users.

- Collections (Loan repayment, EMI): The transaction limit is raised to ₹5 lakh and the cumulative daily limit to ₹10 lakh to promote easier repayment experiences.

- Jewellery Buying: There is a reasonable increase to ₹2 lakh per transaction and a ₹6 lakh daily limit, serving high-value purchases frequently made online.

- Business/Shopkeeper Payments: The transaction limit is ₹5 lakh per transaction, with no limit per day, supporting bulk business transactions.

- Foreign Exchange Retail through BBPS and Digital Opening of Accounts: The threshold for foreign exchange retail payments and opening digital accounts has been increased to ₹5 lakh per transaction, whereas initial funding in digital accounts is limited to ₹2 lakh.

Person-to-Person (P2P) Transaction Limits

Notwithstanding the increases in charges for merchant and business transactions, the NPCI has left the cap on Person-to-Person (P2P) transactions at ₹1 lakh a day. The member banks still have the freedom to decide on lower internal limits depending on their risk strategies.

ALSO READ | How to File ITR Online by Self Without CA’s Help | Step-by-step Guide

Significance and Likely Impact

This rise in UPI limits is a well-timed boost that will release more value and convenience for merchants and users, eliminating the pain of breaking down high-value payments into successive transactions. It also helps India’s effort to go digital by enabling faster, cheaper, and frictionless payments. Experts opine that these increased limits will fuel larger use of digital payments in segments such as insurance, capital markets, travel, and government services and enable India to leapfrog in high-value digital finance.

Overall, with per-transaction limits now reaching ₹5 lakh for essential segments and daily limits of up to ₹10 lakh, UPI has emerged as an even stronger weapon to help provide for India’s growing digital payment demands, effective from September 15, 2025.