Across the world, the coronavirus pandemic has made homes the new focal point – for now, and very possibly also in the future. In an unlikely twist to the Indian real estate story, working from home is now at least partially juxtaposed against the commercial office narrative. As work commutes become less of a factor, and the ability of a home to double as a surrogate workplace is thrown into sharper relief.

“Homes are now the ultimate multitasking assets, and housing prices are once again centre-stage. There is increasing perception that it makes sense to own a property that one lives as well as works in. Property size now matters more than when home and office were distinctly separate concepts. While the question of affordability still looms large over most Indians’ home buying decisions, property price growth has gradually stagnated. The value of property, defined by size and location, is now distinctly higher. Also, while there is no denying the challenges presented by the current COVID-19 pandemic, India’s residential market now favours end-users. “said, Prashant Thakur, Director & Head – Research, ANAROCK Property Consultants.

“This was not always the case. In earlier years, there were steep price growth spikes on account of speculative buying and selling. Homes previously were traded like commodities, severely hampering the options of genuine end-users.”

Price Growth – What the Data Reveals

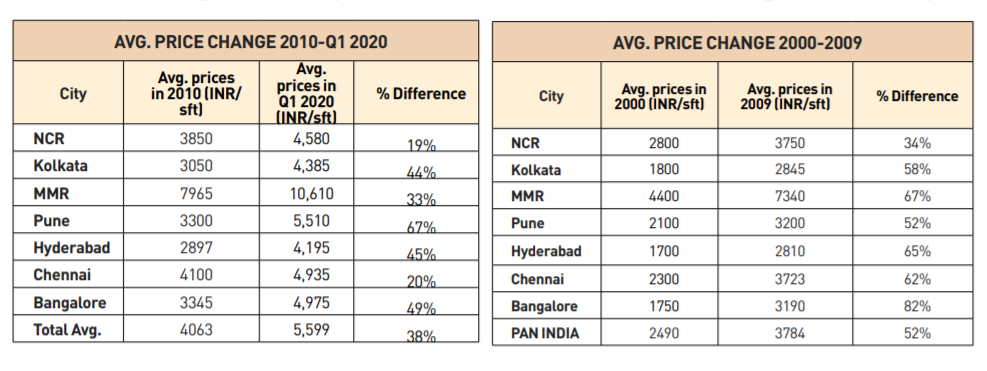

As per ANAROCK research, average property prices in the top 7 cities in the last decade (2010-Q1 2020) saw a close to 38% jump. The average price of a home in the top 7 cities rose from approximately INR 4,063 per sq. ft. in 2010 to INR 5,599 per sq. ft. by Q1 2020.

Among the top 7 cities, Pune saw the maximum rise of 67% during the period. This was followed by Bangalore with a 49% jump, and Hyderabad with 45%.

• Avg. prices in Pune were approx. INR 3,300 per sq. ft. in 2010 and rose to INR 5,510 per sq. ft. in Q1 2020 – a 67% jump. Interestingly, contrary to trends in all other top cities, Pune prices saw lower growth (of 52%) in the preceding decade of 2000-2009.

• In Bangalore, avg. property prices stood at INR 3,345 per sq. ft. in 2010 and rose to INR 4,975 per sq. ft. in Q1 2020 – a 49% rise. In the 2000-2009 period, the city witnessed a 82% jump.

• Hyderabad witnessed a 45% increase in prices in the last decade – the avg. price in 2010 was INR 2,897 per sq. ft., increasing to INR 4,195 per sq. ft. in Q1 2020. In the 2000-2009 period, the city witnessed a 65% jump.

• Kolkata saw a 44% rise in average property prices – from INR 3,050 per sq. ft. in 2010 to INR 4,385 per sq. ft. today. In the 2000-2009 period, the city’s prices rose by 58%.

• Mumbai Metropolitan Region saw a 33% increase in property in the last decade. The avg. price recorded in the region in 2010 was INR 7,965 per sq. ft. while in Q1 2020 it had increased to INR 10,610 per sq. ft. In the 2000-2009 decade, the city saw a whopping 67% jump – the highest among all cities.

• Chennai saw average price rise by nearly 20% in the 2010-Q1 2020 period. The avg. price recorded in the city in 2010 was INR 4,100 per sq. ft. while in Q1 2020 it had increased to INR 4,935 per sq. ft. In the 2000-2009 period, the city witnessed a 62% jump.

• Interestingly, NCR saw the least increase in property prices – by 19% between 2010-Q1 2020 period. The avg. price recorded in the region in 2010 was INR 3,850 per sq. ft. while in Q1 2020 it had increased to INR 4,580 per sq. ft. In the 2000-2009 period too, the city witnessed the least price rise of 34%.

In the initial 5-year period between 2010 to 2014, average property prices increased by anywhere between 5-7% Y-o-Y. Thereafter, growth began to slow down significantly – ranging between 0-2%.

However, in the decade between 2000 to 2009, average property prices jumped by almost 52% – from INR 2,490 per sq. ft. in 2000 to INR 3,784 per sq. ft. in 2009. In contrast, the growth in average prices between 2010 to present is approx. 38%.

Speculative price growth has been significantly curtailed in the last decade. While the steep price increases of the preceding decade obviously favoured investors, they now account for less than 10% of residential property buyers in India. In the current era, end-users are in the driver’s seat.